By Steve Dziver

Editor’s note: Steve Dziver is an agricultural commodity market analyst who owns and operates Commodity Professionals Inc., based in Winnipeg. He can be contacted at steve@commodityedge.ca.

Have you ever opened an email on forward contracting or checked hog prices from a packer’s publication and wondered, where did those prices come from? Or have you noticed a change in lean hog futures that did not match what happened in forward prices reported by a packer on the same day?

If so, you could probably benefit from an exploration of the mechanics used in creating forward contract prices for market hogs. While analyzing the market value and direction is the goal of forecasting, to understand how this is done, we must examine how Canadian forward contract prices are made in the first place.

Cash versus futures: today versus tomorrow

In simple terms, Canadian forward contract prices are calculated using a similar method as weekly cash, except that instead of using a specific regional cash price to start from, like the U.S. Department of Agriculture’s (USDA) LM_HG201 report, every forward contract price, regardless of packer or contract, must begin from the former Chicago Mercantile Exchange’s (now CME Group) lean hog futures. The lean hog futures then must be adjusted to represent the specific cash price of the region or packer, with characteristics such as ‘like terms’ of the cash price being used by a packer and also the correct ‘timing.’

Weekly Cash Calculation = USDA cash hog report [multiplied by] Packer Factor [multiplied by] Exchange Rate [equals] the price in Canadian dollars (CAD) per kilogram (kg)

Forward Contract Calculation = (Lean hog futures + basis) [multiplied by] Packer Factor [multiplied by] Exchange Rate [equals] the price in CAD/kg

The necessary adjustment shown above is known as ‘basis’ and can be defined as the difference between lean hog futures and a specific cash price. From that point, there are endless basis calculations that can be made on a given day, let alone per week. If, for example, there are 50 different cash prices that can be derived from all the USDA hog and pork reports, then, by default, there will be 50 basis numbers reported for that day.

Basis achieves two major adjustments: 1) altering lean hog futures to be like a specific cash price and 2) changing the value of the lean hog futures relative to when it is being used during the allotted coverage period.

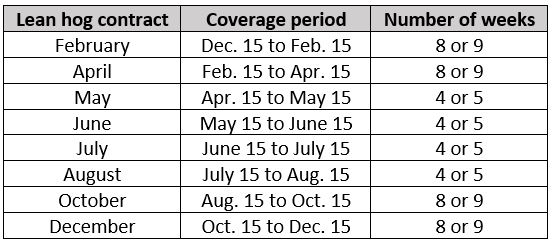

There are only eight lean hog futures to cover 52 weeks, meaning some lean hog contracts are used to cover as many as eight or nine weeks in the year. To better understand lean hog futures, producers who use forward contracting programs should understand that lean hog futures of any trading month are the market’s best guess of cash on one day – the day that contract expires.

Because lean hog futures have a cash settlement, an expiring lean hog contract must match the two-day settlement CME lean hog index (LM_HG201) on the day of expiry. What that means is, as futures trade up and down throughout the course of a year, the contract value is based on a prediction of how the market will behave at that point, based on the information and historical trends at present.

For example, December 2021 lean hogs trade at a different value nearly every day and recently have been as high as U.S. dollars (USD) $89.55 per 100 pounds (cwt) on June 10 and as low as USD $74.12/cwt on June 24. Neither of those prices mean anything concrete, other than representing the market’s best guess of what cash is going to be on the day the December 2021 contract expires – somewhere around December 14.

Every closing price and every daily change between the day a contract starts trading to the day it expires is just a bunch of guesses. Opportunities arise when the market moves a contract much higher than where it eventually expires, giving producers a chance to hedge something better than cash.

Conversely, when the market moves the lean hog futures guess lower than what it will expire at, producers may find their returns to be worse than the cash value, meaning there is opportunity for packers to take advantage of lower carcass or cutout values, depending on how their contracts are formulated.

If you would like more information, Alberta Pork’s website (albertapork.com) includes further explanation on weekly cash calculations, according to individual packers’ contracts.

Basis trends come from historical observations

As anyone following the market would expect, there are trends in basis heading into expiry. Although the trends in futures may not be known, basis often follows patterns during certain times of the year. The easiest week to predict lean hog basis is during the week of expiry, as the market knows it must merge to near zero, which means that basis tightens. However, during all weeks before that – which could be as many as eight or nine weeks in the case of February, April, October and December (which all cover two months) – price adjustments can be significant.

Even if two cash prices use the same report but use different values from that report, the basis levels will be different. In the LM_HG217 report – which now summarizes multiple USDA cash regions, such as the LM_HG203 (National), the LM_HG206 (Iowa/Minnesota), the LM_HG212 (Western Cornbelt) and the LM_HG210 (Eastern Cornbelt) – each will potentially have a slightly different value, resulting in a slightly different basis when calculated against the CME futures.

The LM_HG217 daily report provides a value for each independent market on a given day. In the following example, prices are for June 30, 2021. Since the second half of June and the first half of July rely on the July lean hog futures to provide price estimates, basis is calculated against the July lean hog futures using these cash values. The futures used for specific weeks will be explained further on.

The close of July lean hog futures on June 30, 2021 (the same day the cash values were reported) was USD $107.47/cwt. The daily basis for each of these three cash markets are, by default:

- $113.02 [subtracted by] $107.47 [equals] $5.55 for the LM_HG203 report

- $114.14 [subtracted by] $107.47 [equals] $6.54 for the LM_HG206 report

- $114.42 [subtracted by] $107.47 [equals] $6.95 for the LM_HG212 report

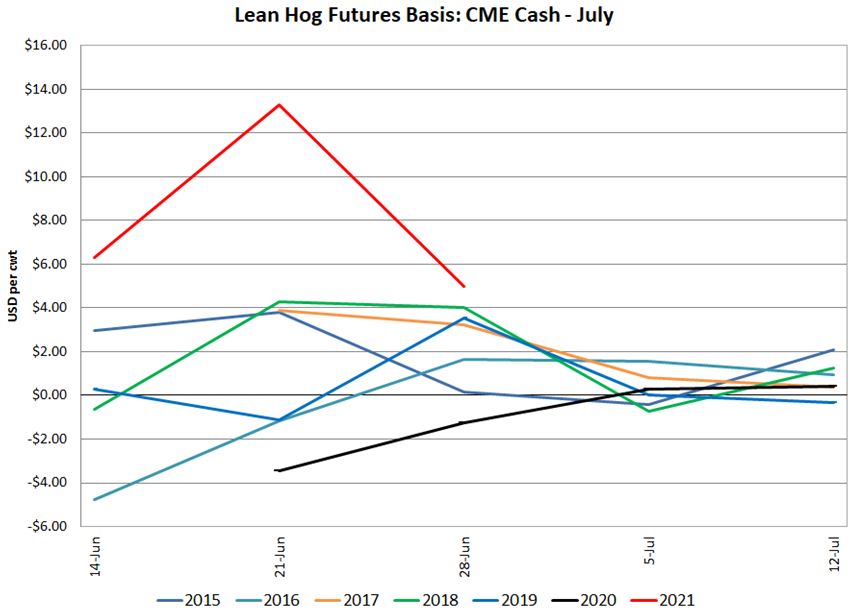

Figure 1 is an example of weekly basis (LM_HG201 report) for the period of June 15 to July 15, measured against the July lean hog futures for the last five years. As is quite noticeable, this year, basis has been extremely positive, meaning cash was considerably higher than the July futures but is narrowing (or coming down, closer to zero, towards contract expiry).

The basis numbers reported in Figure 1 are sometimes referred to as inverted basis, because they are positive, meaning the cash market is higher than futures during this time. An inverted basis can indicate a downward-trending cash market, as futures are anticipating lower cash values when expiry is scheduled to occur. The easiest way to explain inverted basis is by looking at production weeks in late August and early September.

Cash markets in late August are typically coming off the summer highs, and when compared to October lean hog futures, cash is typically higher. Since August lean hog futures have expired, and October is the next contract to use, inverted basis values are almost always reported. Inverted basis does not necessarily represent a better marketing opportunity for producers, but rather, that cash value is higher than the comparable futures for that week. Depending on the fixed basis that a packer has applied to a specific marketing week, forward contracting could still be a better option to maximize returns.

If the basis calculation previously explained was completed five times – once for each day of the week – you would then have a weekly basis number for that specific week in 2021 for each of those cash-reported regions. There would then be the same calculation for 2020 using cash and futures for that year and in 2019, 2018 and so on. Weekly basis can be calculated in history for decades, as far back as futures and cash have been reported.

Basis is based on what?

Basis is the result of history. The market does not know what basis is, until it happens. Daily basis is known at the end of a trading day, and weekly basis is known at the end of a trading week. Since hogs are traditionally shipped weekly, and forward contract prices are offered weekly, most basis calculations are done weekly using a five-day average. As a result, there are 52 weekly basis values reported per cash price – one for every week of the year.

The weekly basis is then applied to a certain lean hog futures contract, making up the forward contracting price for that specific week. A different weekly basis would be applied to the next week but using the same lean hog futures to make up the forward contract price for the following week. That is why you do not commonly see forward contract prices the same for several weeks in a row; it is because packers have applied a different basis for each week. There are commonly reported weeks that have the same value, which means the packer has decided to use the same basis value over those two weeks. Figure 2 illustrates the usual period covered by each lean hog futures contract and the number of weeks it can be used.

The dates in Figure 2 are only estimates and can change from year to year. The reason a lean hog futures contract only covers to approximately the 15th day of the month is because every lean hog futures contract expires on the 10th trading day of the month. For example, July lean hogs will expire on the 10th trading day of July 2021, excluding holidays, which usually means around the 15th of the month. Once a contract expires, it no longer trades, and the next contract must be used to estimate the cash price for the next contract. That is why all contracts cover the second half of the previous expiry month, until the first half of their own expiry month.

Because basis is not known for the coming year, packers must now estimate what basis is going to be in the weeks ahead. Packer basis will usually use multi-year historical basis values – either three- or five-year averages – to predict where the basis could be in the year ahead, allowing them to then provide a fixed price, which producers can use to contract pig production.

Basis is usually calculated as cash minus futures, so when the futures are higher than the cash, the basis becomes a negative number. In Figure 1, June cash happened to be higher than July futures, so basis was positive.

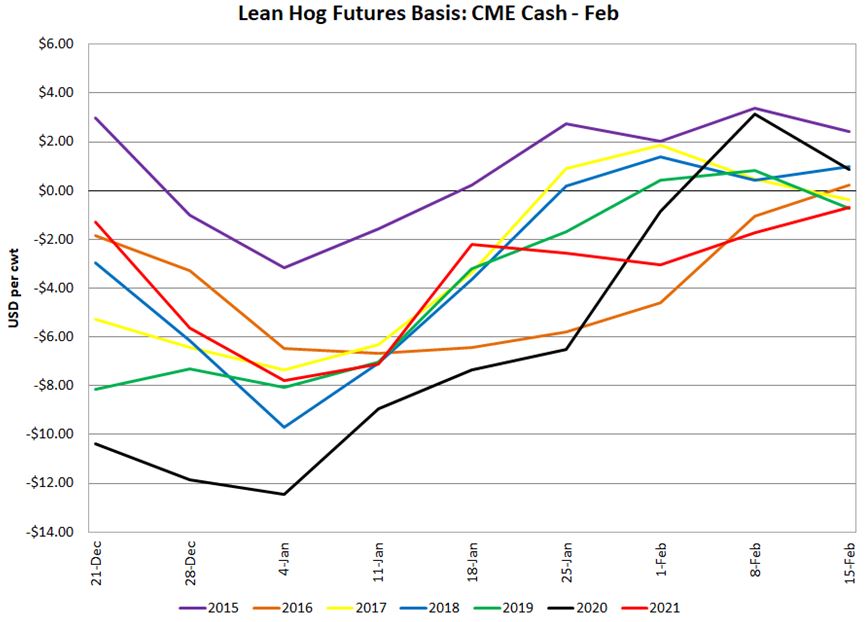

Figure 3 illustrates the opposite of Figure 1. Historical basis for the February lean hog futures against the CME cash (LM_HG201) is commonly negative. The reason for the negative basis is that a higher market is usually anticipated in the middle of February compared to the lower cash weeks of late December and the beginning of each calendar year. Negative basis simply implies cash is usually lower during a specific period (in this case, one week) compared to the next futures month. February lean hog futures cover eight or nine weeks of production, which begins before the contract expires (in this case, December). Similar to the inverted basis shown in the July contract in Figure 1, basis in both cases narrows toward zero at or near expiry.

Fixed forward contracting equals calculated risk

Once research is completed by a packer on historical basis, it allows them to make the appropriate adjustment to the futures, to offer a price to the producer who wants to contract. Packers will traditionally use a multi-year average with some protection to be certain that the price they have offered is in line with the adjustment that is expected for the weeks prior to expiry.

Packers do not always get basis correct, and in many cases, they have offered a price that was too high, or in other cases, too low compared to cash during that week. Lean hog futures trade up and down, which provides coverage to both the producer and the packer. There is little risk to either participant when considering futures alone; however, when considering basis, there is risk.

The basis risk lies entirely with the packer in the case of a fixed forward contracting price, because the packer is providing a price to the producer that will not change. A similar approach to setting basis and assuming basis risk applies to marketing agencies that provide fixed pricing forward contracts. For that reason, the risk of providing forward contracting is typically covered by taking a premium over basis to cover unforeseen results.

Producers who are using fixed forward contracting for price protection should have confidence that the prices they are receiving are based on historical average basis applied to ever-changing lean hog futures with some additional protection basis, which allows the administrator of the program to run and offer such contracts.