By Andrew Heck

Unless you have been living under a rock or in some kind of banana republic with absurdly worthless currency, you have probably noticed that things have gotten pretty expensive in the past year especially, from farm supplies to food.

At the 2023 Banff Pork Seminar, two presenters, Brett Stuart of Global AgriTrends and Steve Weiss of NutriQuest, offered their analyses of the year to come, as it relates to market impacts on the pork industry.

COVID-19 aftermath, cash and China

COVID-19 created a lot of unpredicted and unprecedented market hiccups, but for the most part, its effect on market conditions today has waned, but not without leaving a long-term mark.

According to Brett Stuart, food price indices have stabilized since COVID-19 started, but that baseline has increased by 20 basis points, due to inflation created by increased money supply. In 2020, global broad money supply was 143 per cent of global GDP, and that proportion of money to GDP continues to increase.

“We’re not going back. Don’t hold your breath,” said Stuart. “I’m not saying things are never going down, but it won’t be the same.”

While interest rates are on the rise and concerning, Stuart does not expect them to reach double digit rates of the early-1980s. He expects two or three more rate hikes this year, and then they may actually start to come down.

“The Fed [U.S. Federal Reserve] talks tough to scare the market into compliance,” said Stuart. “That’s what they do. But how hawkish are they going to be this year?”

A large part of the reason why the money supply grew was economic stimulus activity related to COVID-19. In theory, the stimulus was meant to support those who needed it most – such as those who were left out-of-work due to lockdowns – but Stuart posits that more of the money ended up in the pockets of corporations, rather than providing the intended effect of increased consumer spending. While inflationary periods can cause consumers to tighten their budgets, a lot of that activity may be related to the nature of the expense. Unfortunately for our friends in beef, that means them.

U.S. beef production is expected to be down by seven per cent in 2023, representing the single-largest drop in 44 years. This could result in a decline in consumption of around two pounds per person. However, beef’s loss is sometimes pork’s gain, and based on data following the 2008 global recession, pork fared OK during that time. If we head toward a similar situation in the months ahead, Stuart speculates the situation could be the same.

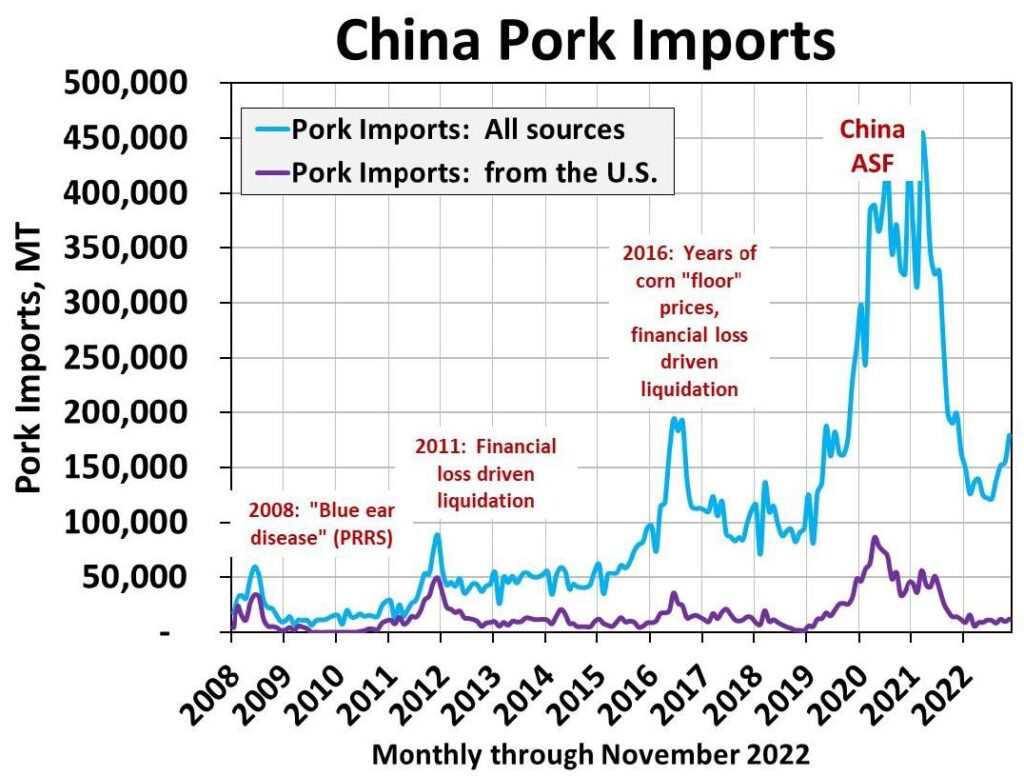

Looking internationally, Stuart is not confident much U.S. pork will go to China this year. Reports suggest Chinese domestic production is at its highest in the past eight years, after a sharp decline due to African Swine Fever (ASF) starting almost five years ago.

“They can live without us, but can we live without them? The simple answer is that, if Mexico keeps buying our pork, we can live without China,” said Stuart. “[U.S. and Canadian pork exports] ebb and flow with China. The only growth market is Mexico.”

Mexican domestic hog prices have been at a record high, which benefits U.S and Canadian exports. The corn price in Mexico has contributed to elevated feed and hog prices domestically, growing the demand for foreign pork.

“It’s the only country in the world where production’s increasing, consumption’s increasing, imports are increasing and exports are increasing,” said Stuart. “What it is, is rising incomes.”

Input costs show no sign of slowing down

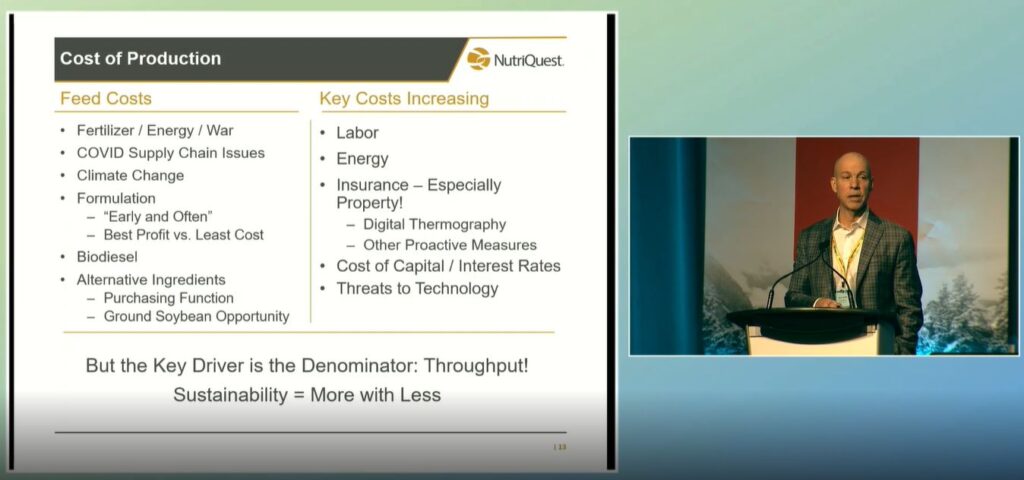

Steve Weiss examined the angle of profitability in the face of high input costs as the focus of his presentation. He expressed some strong concerns about what lies ahead this year, in that regard, suggesting costs will put extreme pressure on business leaders in the hog sector.

“It’s pretty scary and eye-opening what people are looking at in 2023,” said Weiss. “In a commodity business, cost is king.”

In this timeline of rampant inflation, where is the value going for pigs and pork? Weiss suggested the consumer price of pork was shared more evenly between producers, packers and retailers decades ago, but over time, retailers have begun to absorb the lion’s share of profits.

Looking back on his time starting out in the industry, in the early-1990s, Weiss recalled a time when hog industry growth was all but inevitable. The future was brighter then, as he believes the industry has stagnated in recent years, despite optimism it might have become more streamlined and equitable.

“There’s always been a win-lose mentality between producers and packers,” said Weiss. “And I’m not sure that’s sustainable.”

According to Weiss, the most successful producer-packer negotiations result from producers treating packers as their customers. In the absence of price discovery, this is the best approach for producers.

In the U.S., cost of production has increased by at least one-third in two years, but there is high variability among producers Weiss works with. Being creative with alternative feed ingredients is also picking up interest, such as upping soybean meal rations in diets.

Disease issues and mortality also play an overlooked role in what contributes to costs. The spread of porcine reproductive and respiratory syndrome (PRRS) and porcine epidemic diarrhea (PED) in the U.S. could give Canada an advantage this year, he thinks, given our high standards compared to other jurisdictions.

“You look at China’s hog hotels, and Canada is kind of the opposite, with so much land and good biosecurity,” said Weiss.

With fertilizer prices through the roof, Weiss suggested the value of manure is greater than hog profits currently, for some, but that value is not being adequately recovered by producers. On top of cost savings, using manure responsibly is part of our industry’s sustainability story. Capturing the value of manure and assigning it a dollar value is necessary. Failing to do so is a missed opportunity, which speaks to poor risk management strategies.

“If you don’t do [business risk management] methodically, it’s just not sustainable,” said Weiss.

Weiss has seen how businesses with disciplined risk management approaches are doing the best right now. Operating passively is dangerous in the marketplace today, and benchmarking your losses and gains is vital to improvement. To do so, information needs to be timely and accurate.

Living with the reality of an industry experiencing contraction, Weiss also highlighted the importance of succession planning for those looking to retire or otherwise make an exit from the sector. As the marketplace becomes harsher for independent producers, this may lead to further consolidation and vertical integration but not necessarily expansion of the total hog herd.

Prices versus costs: a balancing act

In recent years, the list of problems for the hog industry appears to have gotten longer than the list of solutions. Perhaps it has always been this way, but as we trend toward stricter budgeting, increasing consumer demands and a more competitive labour pool, pig production and pork processing alike may be forced to continue limping along in 2023 without much financial reprieve except the prospect of hog prices hovering above the five-year average.