By Andrew Heck

When Russia invaded Ukraine earlier this year, many people around the world were appalled at the violence and atrocities. In Canada, the prevalence of Ukrainian identity differs from one region of the country to the next, but on some parts of the prairies, it is inescapable – a fundamental part of the cultural fabric.

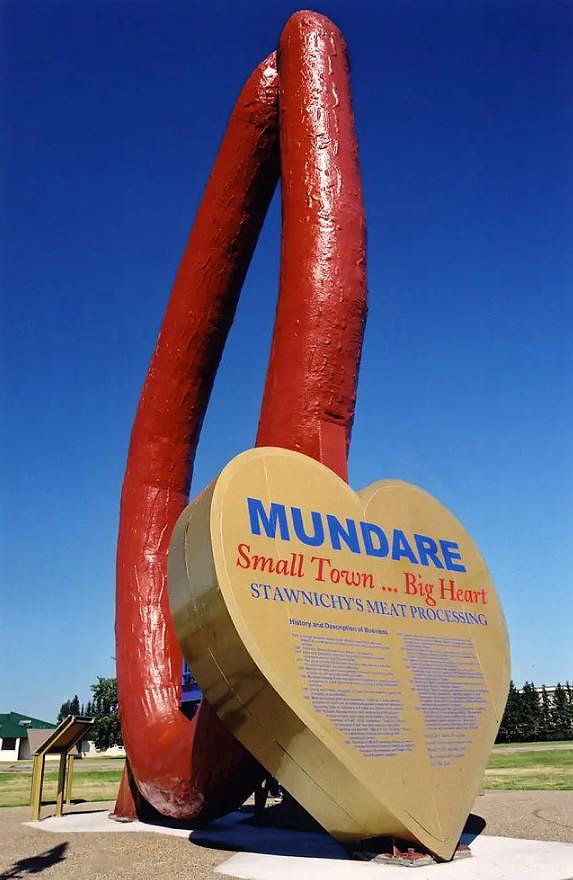

Mundare is a town of nearly 1,000 people, located about 100 kilometres east of Edmonton – in the heart of ‘Kalyna Country’ – representing a collection of settlements and other heritage sites demonstrating the Ukrainian presence in east-central Alberta.

Among the most recognizable institutions of the area is Stawnichy’s Mundare Sausage – formerly known as ‘Stawnichy’s Meat Processing’ for many years. The company is recognized for offering many delicious meat products and Ukrainian heritage foods, with probably none more famous than the original smoked sausage ring. Served hot or cold, customers can find it at Stawnichy’s deli in Mundare, at their dual deli-and-restaurant space – Uncle Ed’s Restaurant and Mundare Sausage House – in Edmonton and at many grocery locations across the province. You might even come across it being sold for a minor hockey team fundraiser!

Small-town butcher shops are often held in high esteem by those who frequent them – family, friends and neighbours of those business owners. Stawnichy’s takes that a step farther, penetrating urban markets that have little to no association with Mundare, the town. Thanks to years of hard work and dedication to high quality, Stawnichy’s reputation today precedes it.

A little company with a big reach

Ed Stawnichy began processing meat products on the family farm, starting in 1959. Since then, four generations of his family have been involved in the operation, including Ed’s grandson, Kyler Zeleny, who plays a key role in directing the business.

“My gido [grandfather] always had core values for our company,” said Zeleny. “My baba [grandmother] still works in the shop six days a week, not because she needs the paycheque, but because she loves it.”

Zeleny grew up on a farm outside of Mundare and spent plenty of time at the shop over the years. Eventually, he left to pursue higher education, including a PhD, but has since returned to his rural roots.

“I started working in the shop as a teenager, but even when I was younger, it was a bit like the local daycare for us. At one point or another, we’ve had probably two dozen family members working in this company.”

For Zeleny, the success of Stawnichy’s is closely tied to Ukrainian identity and mentality.

“Early on, everyone here was Ukrainian. Those pioneers had the same instincts as ‘hustle culture’ today: you keep moving, you never put all your eggs in one basket, and you remain grateful.”

Diversification has always been an important strategy for Stawnichy’s to maintain its business.

“We keep our food simple and authentic, but we’re always trying to modernize where it makes sense. In the end, it’s still hearty, filling, homemade, family-style food. We’re looking at adding additional Ukrainian products to our lineup in addition to new non-Ukrainian products.”

Still, the sausage reigns supreme! Over six decades, millions of sausage rings have been smoked. If straightened, each ring measures about two feet in length, which means Stawnichy’s has smoked enough sausage to stretch all the way between Mundare and Kyiv, and then halfway back again. That would seem true-to-form for Ukrainians, whose idea of hospitality typically includes very generous portions of food.

“We’re privileged to have what we have. We’re truly fortunate.”

Modern times, timeless products

Stawnichy’s does not have its own hog slaughter capacity, but the company does try to source its pork as locally as possible. Often, that means from abattoirs within Alberta but also from other parts of western Canada, when necessary.

“It’s difficult, because there aren’t as many suppliers out there as we would like,” said Zeleny. “I think we need better funding and opportunities for smaller facilities. That provides more options for producers and provides better food security for consumers.”

Stawnichy’s facility in Mundare is the site where virtually all of the company’s products are processed. The facility is part of the provincially inspected system, which means the company is unable to market products outside of Alberta; however, entering the federal system has crossed Zeleny’s mind.

“It’s possible within five or 10 years we would consider it. But I wonder, are we happy with our size? Do we need to get bigger? Growth upon growth isn’t something I believe in. It’s just not who we are.”

As time goes on, Stawnichy’s proliferation of the retail market continues to expand, with more than 190 stores in the province carrying their products. They recently underwent a rebranding of all their packaging, and they are considering the possibility of opening a new deli and restaurant in south Edmonton, to complement their northside location.

“COVID-19 changed things for sure. We had to close our restaurant in accordance with public health restrictions, and our fundraising efforts for local sports teams took a major hit. Like all businesses, we faced higher costs and reduced supplies, which has made it difficult.”

Unmotivated by the prospect of exponential growth and wealth for the family, Stawnichy’s makes a point of hiring local workers, but recently, two refugees from Ukraine were brought on board to work in meat cutting.

“We like to think we’re an integral part of our community and for those who choose to live here. We think small-town life is important. When two Ukrainians approached us not long ago, however, we hired them on the spot. It was a no-brainer.”

In addition to hiring Ukrainians, Stawnichy’s has pledged more than $10,000 directly in support of Ukraine, while also supporting the local community on an ongoing basis through the Edward E. Stawnichy Foundation, which provides scholarships to area high school students, along with funding other charitable initiatives for local residents.

“We’re happy to feed people and offer a product that has a lot of quality. We’ve been doing the same thing for more than 60 years, and we’re not cutting any corners.”

Mundare is monumental

Just down the road from Mundare is Vegreville – a considerably larger town known for being home to the world’s largest ‘pysanka’ (Ukrainian Easter egg), made from aluminum tiles, constructed in 1975. You may recall seeing it on the front cover of the Spring 2022 edition of the Canadian Hog Journal, published this past May.

Not to be outdone, in 2001, Mundare erected an oversized fibreglass ring of ‘kovbasa’ (the cold-smoked sausage that made Stawnichy’s a household name). A third addition to the visible Ukrainian presence in the region includes a giant fibreglass perogy in the nearby town of Glendon, built in 1993. While these roadside attractions may seem like gimmicks, they are casual reminders that those communities still feel a loving connection to Ukraine.

“This is the mecca of Ukrainian culture outside of Ukraine,” said Zeleny. “The culture is still represented in the local arts, institutions, street signs, businesses, you name it. The cultural complexion has changed somewhat over the years, but the community still remains very Ukrainian.”

On the grounds of the Alberta Legislature in Edmonton, a copper statue commemorates the arrival of Ukrainian settlers in the province, in 1891, and on the grounds of the Saskatchewan Legislature in Regina, another statue serves as a reminder of the Holodomor: the intentional starvation of more than three million Ukrainians in the Soviet Union, between 1932 and 1933.

Clearly, in good times and bad, feast and famine are inevitable defining features of being Ukrainian, and the connection extends from all over Canada all the way back to the homeland.

Food unites us all

In a 2010 interview with Slate magazine, Anthony Bourdain – the late chef, travel writer and TV host – said, “Food is everything we are. It’s an extension of nationalist feeling, ethnic feeling, your personal history, your province, your region, your tribe, your grandma. It’s inseparable from those from the get-go.”

Companies like Stawnichy’s are more than just businesses – they are deeply embedded within their communities and cherished by those they serve. For Ukrainian-Canadians, ‘traditional’ fare like sausage, perogies, cabbage rolls and other staple items not only fill bellies but also cause hearts to swell with pride. When the invasion of Ukraine took place, those hearts – whether in Ukraine or in Canada – began burning with passion.

“With everything that’s happened in our world in the past two years, another catastrophe is not what anyone needs,” said Zeleny. “We just want to help be a part of the solution.”