By Gerry Friesen

Editor’s note: Gerry Friesen is a former hog farmer from southwestern Manitoba. Today, he shares his lived mental health experiences for the benefit of farmers and organizations across Canada.

When I hear presentations on mental health in agriculture, such as the ones delivered by Andria Jones-Bitton and Robyne Hanley-Dafoe at the 2021 Banff Pork Seminar, I am compelled to reflect on my journey in the labyrinth of stress, anxiety and depression.

I call myself ‘The Recovering Farmer’ for two reasons: number one, because we sold our family farm some years ago to pursue other interests, and number two, due to my struggles with mental health.

I am often asked what it means to recover. The dictionary defines it as, “returning to a previous state of health, prosperity and equanimity.” ‘Equanimity’ is a big word, so I checked that as well. It means to, “have an evenness of temper even when under stress.” That, in a nutshell, has been and remains part of my journey.

I grew up on a turkey and grain farm. After graduating from high school in 1978, I joined the workforce for a few years, found a life partner, and was drawn back to the family farm in 1983. Growing up, I had never envisioned myself being a hog producer, but because turkey quota was not readily available, we had to diversify into something else to support two families – so hogs it was.

In the 1980s, my focus and priority was the farm. In the 1990s, I was involved in agricultural politics, serving on the boards of Manitoba Pork, the Canadian Pork Council (CPC) and Keystone Agricultural Producers. In the 2000s, I became immersed in farm debt mediation – something that became life-changing, as I saw a new career path unfold in front of me. And then, since the start of the 2010s, I have been passionate about mental health, particularly in agriculture.

Given how many times I reinvented myself and my career, I often wondered whether I truly was a farmer at heart. In 2007, as I was winding down the farm, I met a feed salesman whom I had gotten to know through my involvement in the hog industry. He asked how I was doing. I told him about winding down and selling our farm, and I suggested to him that I did not think I was a farmer anymore. He looked me in the eye and said that perhaps I never had been.

That statement that night gave me reason for pause and reflection. In my mind, there were different ways of looking at this. Either I was a farmer but had failed miserably, or perhaps my natural aptitude was for other work. Clearly, for the sake of my dignity, I am going with the latter.

Industry issues generate widespread stress

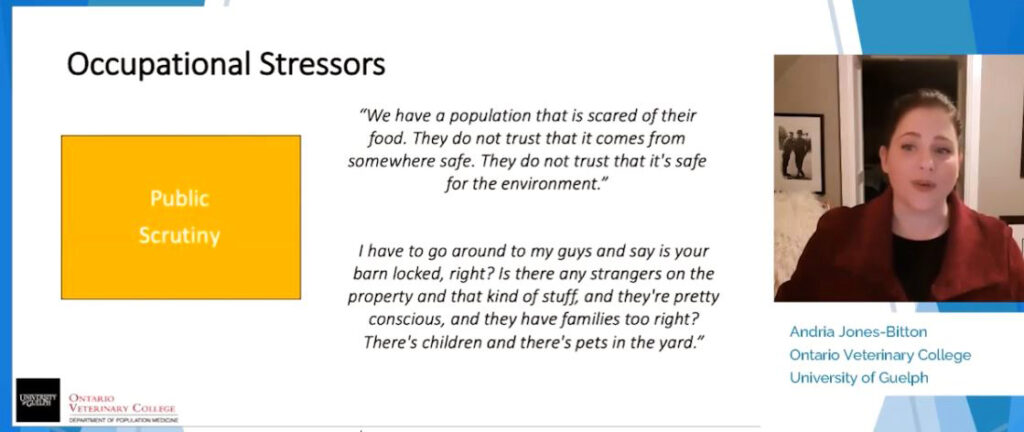

As evidenced by the national survey of farmers headed by Andria Jones-Bitton, agriculture comes with a host of stressors – some that are obvious and some that are not. And not only at the Banff Pork Seminar, but going forward, I would encourage you to explore the many resources available for managing stress, including the ‘In the Know’ program developed by Jones-Bitton’s team, which is freely accessible.

Although certain stressors are general to any farmers, livestock production inherently come with some unique ones. Many farmers are able to rise to the occasion – meeting stress head-on and managing it. For me, it was never that simple.

When we started with hogs, our feed company partner convinced us to try a recently developed nutrition program. It sounded great. We bought our first batch of pigs, and off we were! It did not take long to realize we were having issues. Long story short, our mortality that first year was 33 per cent. Due to a high-density, finely-ground feed, our pigs were getting gastric ulcers. As much as insurance finally kicked in, it was a tough start.

Hog markets have always been cyclical, and certain events during my time as a farmer stand out to me. In the 1980s, U.S. countervail duties impacted our prices. In the 1990s, as the industry adopted pricing formulas based on a North American marketplace, our currency played a major role in establishing value. A low Canadian dollar exchange rate benefited live hog exports to the U.S. for a few years. We were seeing a lot of promise for growth, until the Canadian dollar began to rise, and profits declined significantly. Add to that issues such as mandatory country-of-origin labelling (mCOOL), and you get a picture of how volatile markets can be.

In early 1998, we expanded our hog operation. Just as the production from that expansion was ready for market, the prices plunged to $0.42 per kilogram. That meant that we were marketing hogs at a $140 cost of production, with a market return of just under $40. Anecdotally, it was suggested that hog producers lost 15 years of equity during that time.

Then it became a constant struggle to stay on the right side of the ledger. There was the ongoing attempt to balance business risk management programs with the variabilities of markets. And when that did not work, we restructured. But it never seemed to be a lasting solution. I was often reminded of how my production was enough to feed a small city, but I was having trouble feeding my family.

Government policies were a constantly moving target. There was continued pressure and scrutiny regarding environmental issues and animal welfare. We experienced trade disputes. Today, various disease issues such as porcine epidemic diarrhea (PED) and African Swine Fever (ASF) are ongoing threats to the hog industry. Whenever and wherever you look, there is always some kind of issue threatening hog farmers. At least that much of the experience we all share!

From the political to the personal

Operating a farm comes with many stressors not only from an external point-of-view but also from an internal point-of-view. Maintaining a work-life balance while trying to manage the barn around the clock is a different kind of stress altogether.

In 2003, I was president of Manitoba Pork Marketing, chair of Dynamic Pork and an active mediator with the Manitoba Farm Mediation Board. The hog industry was in a continuous downward spiral, and likewise, so was my farm, as many others in the industry were also experiencing significant challenges.

During a mediation meeting in the fall of that year, I suddenly felt my heart do some interesting palpitations. I felt a shortness of breath and thought I would pass out. It came and went relatively quickly, but it started happening on a more frequent basis to the point where, in early 2004, I sought help from a physician. He explained that I was experiencing anxiety and depression, and that I needed to go on medication. With little to no thought about the intricacies of mental illness, I took the meds. That was the beginning of my recovery – discovery, not so much.

Combined with my ongoing mental health issues and increasing stress, my behaviours started changing. Most notable was an increase in expectations for myself and for others. I could do nothing right and neither could anyone else in my life. My self-esteem reached new lows, which created tension in my relationships with those closest to me.

My coping mechanisms were not particularly helpful. I found out that alcohol does an amazing job of easing anxiety. Unfortunately, as alcohol leaves the body, it increases anxiety. So, the only way to combat that is to drink more, which I did. When I was not in a self-medicated fog, I was finding other means of escaping. I found the hog barn to be a sanctuary – away from people, away from my phone, away from my family, and, perhaps, even an attempt to escape from myself.

In mid-2005, I was on a motorcycle trip with my brother. I had been medication-free for a few months and was functioning quite well, or so I thought. On the last day of the trip, as we were nearing home, I witnessed him crash his bike. That very morning, before we hit the road, we had made the decision to sell the farm. Unfortunately, the relief brought on by that decision was short-lived. After he had his accident, he fell into a coma, and I needed to take over his portion of the work. Life began to overwhelm me.

Shortly following my brother’s accident, and shortly before selling the farm, my wife and I decided I should try talk therapy. I had a session with a psychologist who was not impressed that I was planning to sell the family farm, and at the end of the appointment, he said I needed to go back on meds, because I would not be able to afford his services. After that, I visited a community mental health worker who really tried to assist, but after two sessions, she felt incapable of helping me. So, I went back on meds.

I was always convinced that, should we be able to sell the farm, my depression and anxiety would also end. In 2007, when we were able to sell the farm and move on, it dawned on me that was not the case.

To change your life, change your approach

As part of the farm wind down and as an opportunity to enhance my conflict management work, I applied to the Manitoba Farm, Rural & Northern Support Services line as a volunteer. In retrospect, and entirely unintentionally, that was when the discovery process truly began, and I started to understand how best to manage by mental health.

First and foremost, through the training, I learned so much about mental health and how that related to my situation. Second, I was contracted to facilitate depression workshops for men, which added to my knowledge through research and through meeting and talking to others.

In preparing for my new role, I felt the need to talk to my wife and kids about my depression. I had always thought that I was doing a good job of hiding it but found out rather differently. My wife expressed how I had changed into a different person over time – no longer the person she had married. My kids talked about crying themselves to sleep because of their concern for me and our family’s financial issues. I had no idea, and perhaps it was better at the time. I suspect that, if I had known earlier, the guilt might well have pushed me over the edge.

Was I suicidal at any time? No, but I certainly had thoughts of dying, because in my twisted way of thinking, there would be some benefit. I could relieve my mental anguish, my wife and kids would benefit financially, and the world would be better off without me. I was not afraid of dying; I was afraid of living.

In 2015, I received a call that shook me to the core: the wife of my long-time friend, and mother of their children, had died by suicide. At her funeral, the family shared how they had gained a much better understanding of mental illness. The family was very clear that she had put up a strong fight and had lost, similar to someone who battles cancer but ultimately succumbs to the disease. I had many emotions running through me. I felt encouraged knowing that I and many others had nothing to be ashamed or embarrassed about. And I felt a tinge of envy that she had escaped her pain. But I also felt an incredible fear – afraid that some morning I might wake up and just not be able to face another day.

My recovery has been far from linear. At the outset of sharing this experience, I used the word ‘labyrinth.’ Going back to the dictionary, ‘labyrinth’ is defined as, “a place with a lot of crisscrossing or complicated passages, tunnels or paths in which it would be easy to become lost.” I still live in that labyrinth. But because of a deeper understanding and utilizing what I have learned, it is much easier to navigate without becoming totally lost.

Managing stress is a good first step

In her presentation, Robyne Hanley-Dafoe touched on the symptoms of burn-out, including feelings of energy depletion and exhaustion, increased mental distance from one’s job, feelings of negativity and reduced professional efficacy. She also provided some good techniques for managing these conditions, including letting go of guilt, acknowledging your fears and working toward total mental and physical wellness – whatever that means for you. And I can tell you from experience that taking this seriously is key not only for your own well-being but also for the management of your farm.

Stress impacts us in various ways. It can be quite insidious and can affect us physically, emotionally, mentally and socially. Over time, we may notice subtle changes occurring and tend to ignore these hints. As stress builds or continues over an extended period, the impacts on us increase, and our behaviours change. It is important not to ignore these signs.

Some time ago, my family noticed that I was headed off the rails again and made it clear that I needed to seek additional help. I found myself going to a naturopath appointment, which turned out to be pleasantly surprising, despite my initial cynicism. For the first time ever, someone was able to connect the dots for me. There was no instant fix that day. Rather, it was just the clear understanding of the nuances of my mental health that gave me the extra push I needed to continue my journey in a new way.

Through awareness, acceptance and an effort to be more intentional about my recovery, I can now weather fluctuations better by sticking with the things that help when I experience a bad spell. While I still have bouts of anxiety, or times when my mood is subdued, I can rest assured that the moment will not last forever, and that gives me the ability to experience life as best as possible.

As you become more cognizant of your own mental health and the mental health of those around you – your family, colleagues and others – remember that my experience is not unique in principle. You may be going through something similar. And if you are, there is no better time than right now to nip it in the bud. It may save your life or someone else’s. Having the courage to address my own issues likely saved mine, and because of that, my wife still has a husband, and my kids still have a father today.