By Andrew Heck

The seventh, annual Porc Show was presented in digital format on Nov. 25 and Dec. 3 & 9, 2020, featuring presentations, speeches and an introduction to the Quebec agri-food industry. Guests were invited to network with conference partners, including the Canadian Hog Journal, by visiting an online exhibitor area.

For the past six years, Canada’s largest pork conference has been hosted in-person at the Quebec City Convention Centre, just across from the province’s National Assembly (provincial legislature), down the road from La Citadelle and the 400-year-old Petit Champlain district – typically an attractive location for the conference’s more than 1,000 guests.

“We are very pleased with the outcome of this year’s format,” said Sébastien Lacroix, CEO, Quebec Association of Animal and Cereal Feed Industries (AQINAC), one of the Porc Show’s host organizations. “While we would have loved to welcome guests to our province, the global pandemic has prompted us to adapt, which parallels the work being done in our industry to innovate and overcome barriers to success.”

Each day of the conference was opened by Vincent Cloutier, Senior Advisor, National Bank. Special dignitaries, including Andre Lamontagne, Minister, Quebec Agriculture, Fisheries and Food (MAPAQ); David Duval, President, Éleveurs de porcs du Québec (Quebec Pork); and Marie-Claude Bibeau, Minister, Agriculture and Agri-Food Canada (AAFC) also delivered remarks.

“The pork sector has been courageous and resilient through COVID-19, soldiering on to maintain the food supply and stimulate the Canadian economy,” said Bibeau. “We must maintain solidarity with processors as they continue to operate at a reduced capacity, and we must support producers as they look for alternate solutions to sell their animals.”

Presentation topics for all three days ranged from the impacts of human and swine disease on the global pork trade, pork industry issues management and animal handling. With more than a dozen industry experts on-hand, guests were treated to a diverse and comprehensive array of subject matter.

COVID-19, ASF and global pork trade

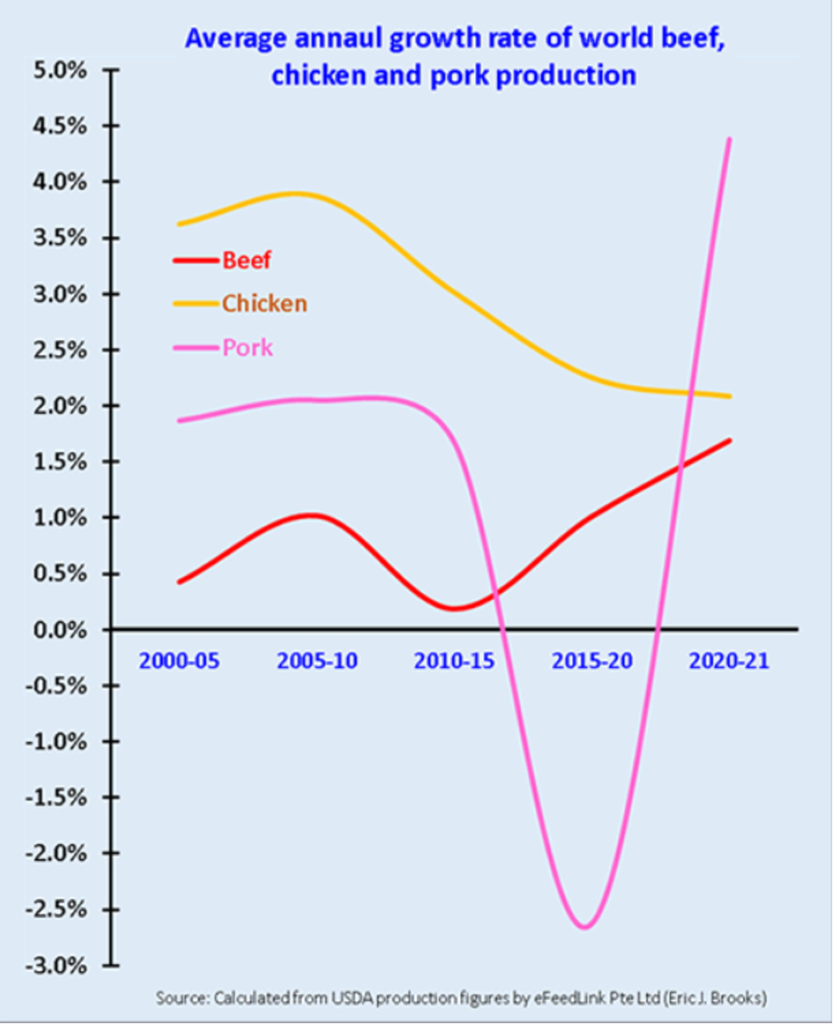

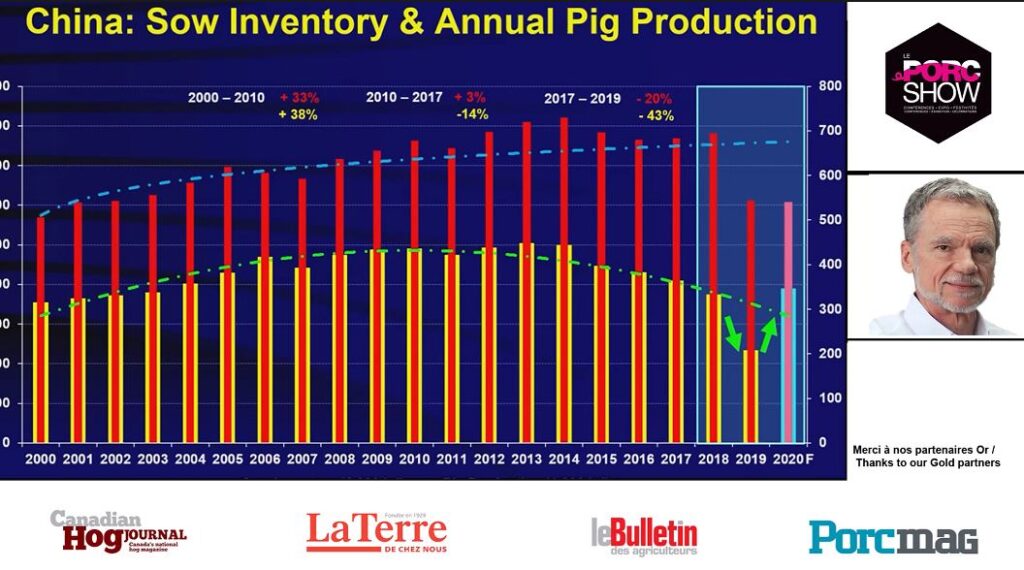

In the past two and a half years, African Swine Fever (ASF) has largely shaped pork demand and sourcing, while in the past 10 months, COVID-19 has impacted the industry in more localized ways. Complications related to ASF and COVID have promoted differing industry responses, tailored to the situations faced regionally. Experts joined the Porc Show this year from Canada, the U.S., the U.K., China, Brazil, Spain and Germany – all keen to explore their national industries’ activities in response to market challenges.

Among all presenters on the topic of trade, not one failed to mention China’s impact on production and profits. For Gary Stoner, Vice Chair, C.P. Group China – a global top-three producer of pork, poultry and other commodities in southeast Asia – China’s ASF recovery has been swift, from banning human food scraps as feed to the construction of multi-storey ‘pig condominiums’ for efficient land use. The domestic price of pork for the country’s consumers varies but remains inflated, as no combination of domestic production and imports has yet been able to fill the growing demand.

In Germany, opportunities in Asia quickly vanished following the discovery of ASF in the country’s wild boar population in September 2020. Albert Hortmann-Scholten, Market Analyst, Chamber of Agriculture, Lower Saxony indicated that German pork is currently banned in 14 countries globally, as a result. Taken together with processing shutdowns related to COVID-19, pig prices in 2020 have dropped by nearly 15 per cent for German producers. In Germany, 80 per cent of all pork is processed by just 10 packers, leading the European Union (E.U.) in pork production volume and trailing only Spain in pig production volume.

In contrast to the German industry’s more recent woes, in Spain, an unusual phenomenon is taking place compared to most other pork-producing countries around the world, according to Miguel Higuera, Executive Director, Spanish National Association of Swine Producers (ANPROGAPOR): the number of farms is increasing. Starting in 2014, the Spanish government capped the size of all livestock farms, but a desire to continue expanding the industry has driven growth. Sixty-five per cent of all Spanish hog farms are integrated with processors, with the remaining 35 per cent equally split between producer cooperatives and independent operations. Spain first started exporting pork only in 1995, and in the quarter-century since then, has actually surpassed Germany when it comes to breeding pigs, exemplifying just how different the conditions are from one E.U. nation-state to the next.

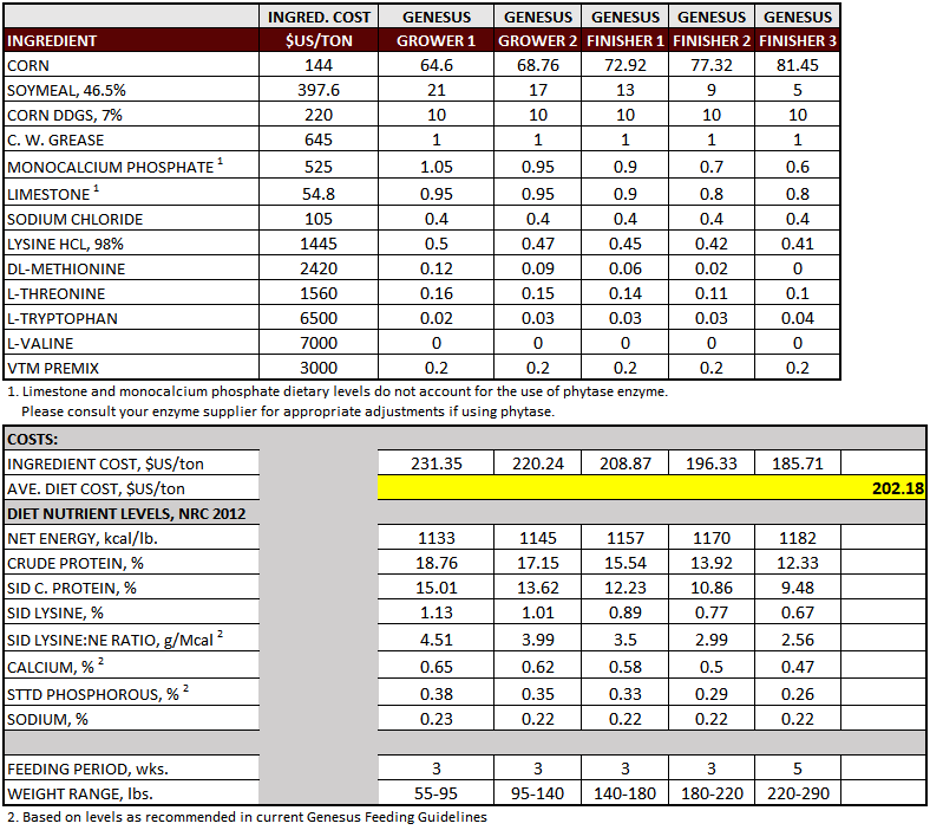

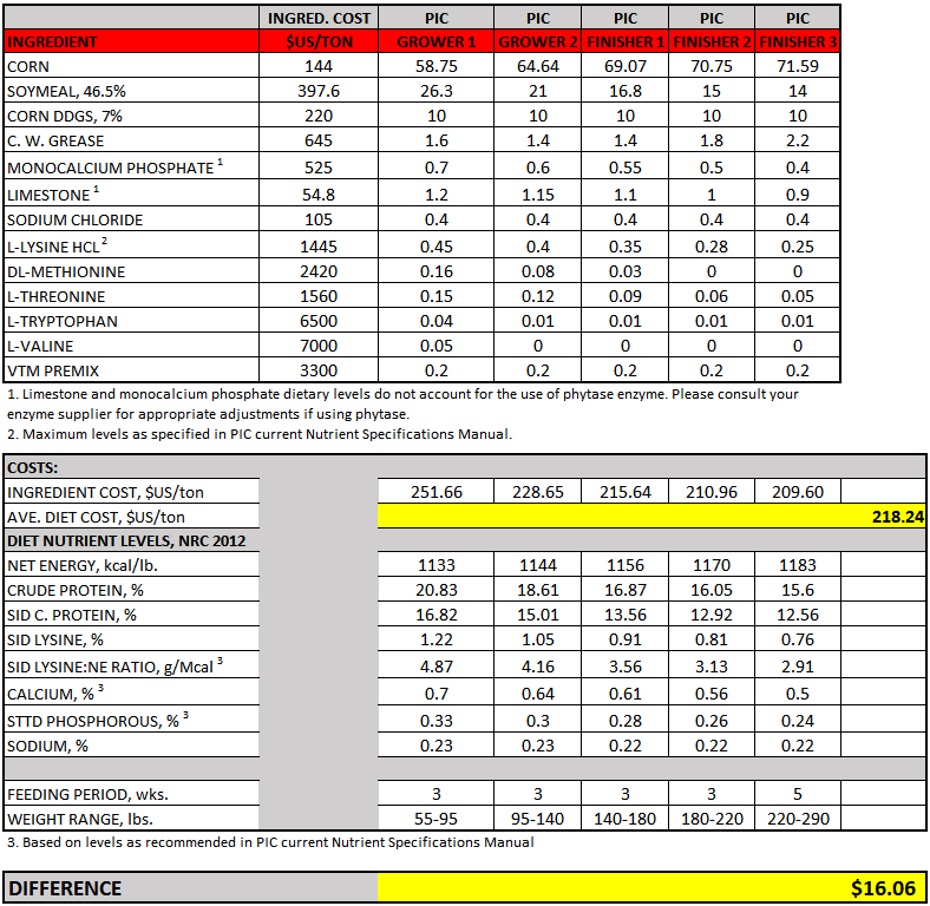

Meanwhile in North America, where ASF has spared the industry so far, COVID restrictions have disrupted the supply chain. According to Steven Weiss, President, NutriQuest of Iowa, plant shutdowns encouraged curtailment of U.S. pig production in the second quarter of the year, but by the fourth quarter, production had returned to near pre-COVID levels. The production response this spring included slowing down diets and euthanizing millions of pigs – an unfortunate yet effective course of action. John Ross, President, Canadian Pork Council (CPC) pointed to a similar albeit much smaller-scale COVID response in Canada, which has included reducing breeding and, when necessary, shipping eastern Canadian hogs to western Canadian plants as a way to back-fill western demand when eastern plants were faced with interruptions.

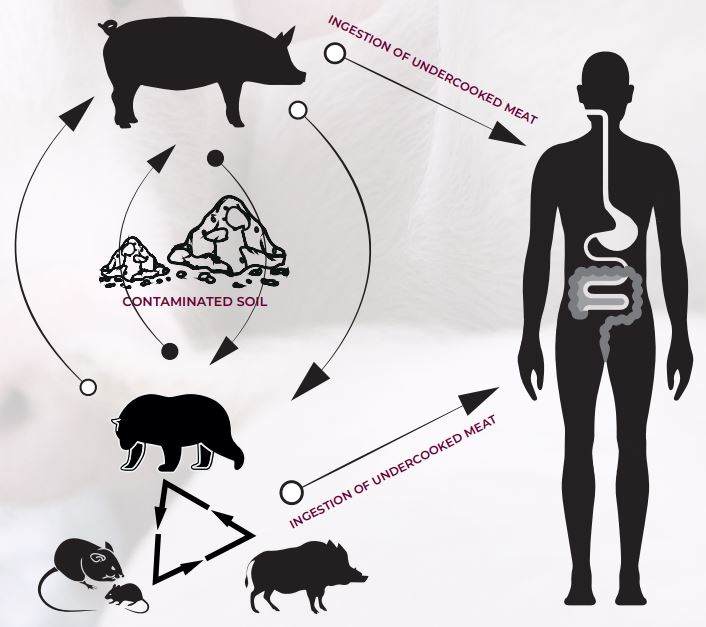

No matter where in the world pigs and pork are found, biosecurity remains top-of-mind. Proper protocols remain important as ever – from farms and trucks to processing facilities and airports, where the potential for disease transmission is ever-present. Martin Bonneau of Demeter Veterinary Services, based in Lévis, Quebec, spoke about a new national partnership in Australia that aims to address biosecurity challenges across all livestock sectors, particularly focusing on international passenger travel and cargo shipping. The partnership is backed by a decade-long plan that is designed to buff up the country’s biosecurity significantly approaching 2030. Like Australia, the Canada Border Services Agency (CBSA) has identified flights from ASF-positive countries as having heightened risk.

Pork industry issues management

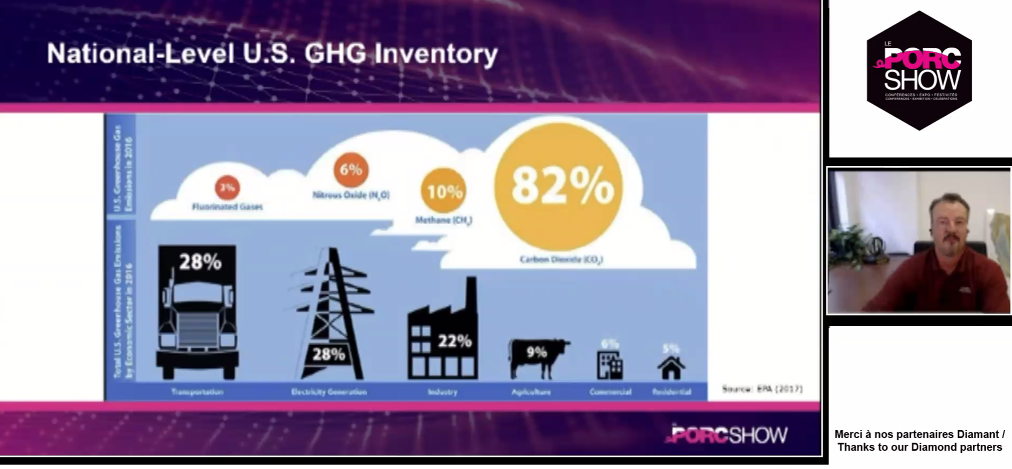

When it comes to climate change, Frank Mitloehner, Air Quality Extension Specialist, University of California believes the pork sector has many opportunities to become better by continuing to reduce methane output through manure management strategies, such as generating renewable products like biogas.

Incentivizing change and sharing knowledge, rather than punishing behaviour, is key to transforming the industry positively. While pig production has a much smaller carbon footprint compared to ruminants like cattle and sheep, feeding a growing global population means raising more livestock. Despite this, Mitloehner points out that comparing greenhouse gases directly – carbon dioxide, nitrous oxide and methane – is like comparing apples and oranges, which is where critics of animal agriculture fail when it comes to arguing the sector’s negative climate impacts.

Mitloehner also suggests that food waste, not livestock production, is the true menace that the agriculture industry as a whole needs to address, as 40 per cent of all food produced globally – or one out of every three calories – is never consumed by either humans or animals. He points out that food waste in the developing world occurs more often at the farm level, since barriers to harvesting crops and transporting commodities are more common than in North America, where much more of the waste occurs at the level of retail and home consumption.

If everyone on Earth switched from an omnivorous diet to a vegan diet, would that save the planet? Mitloehner believes that such a dramatic hypothetical change would result in an overall greenhouse gas reduction of less than one per cent. Despite that reality, vegans and animal activists continue to push this narrative.

And while Canada is no stranger to the harmful actions of animal activists, in Europe, highly organized networks have infiltrated the industry for even longer and with greater influence. Groups like L214 Ethics & Animals recruit mostly young and impressionable individuals through social media as foot soldiers for threatening pork producers and processors, while instilling fear in public figures and politicians who sympathize with the livestock industry.

According to Jacques Crolais of Brittany, France’s Meat Producers Union, the European anti-meat movement is led primarily by urban millennials who use online fundraising to support campaigns of misinformation, along with criminal trespassing and espionage.

Whether by distorting the pork sector’s impact on the environment or by targeting meat production and consumption itself, critics continue to take pot shots at the industry, which has been forced over time to cushion such reputational blows.

Animal handling, health and welfare

While the Porc Show has an undeniably business-oriented character, no pork conference would be complete without a little testimony from those who study pigs the hardest: veterinarians.

Jean Brochu, a swine vet with Sollio Agriculture, provided an overview of behavioural problems that emerge with uterine and rectal prolapses in sows. The condition often goes unaddressed without constant monitoring, and it has a mortality rate of anywhere between less than one per cent and upwards of 10 per cent. It is difficult to pinpoint commonalities between herds, as few concrete conclusions have been drawn to connect indicators from one farm to the next.

Georg Dusel, Professor of Animal Nutrition and Health, University of Applied Sciences in Bingen, Germany spoke to the role of fibre in sow management. He pointed to the fact that not all carbohydrate sources are created equal when it comes to digestible fibre, and sows at different stages of gestation and farrowing have unique dietary needs, even as it relates to using crates versus group housing.

François Cardinal with Triple V Emergency Veterinary Services of Vale, Quebec presented on the challenges and eradication strategies related to Porcine Reproductive and Respiratory Syndrome (PRRS). On an average litter of piglets, the cost of managing PRRS can be anywhere between $50 and $60. The most effective strategy, according to Cardinal, is a herd closure until negative tests come back in four consecutive litters, lasting for a period of six to nine months, at which point the herd can be carefully reopened with close attention paid to biosecurity protocols. For farrow-to-finish operations, increasing the marketed weight of hogs can also create better pig flow and optimize productivity while managing the disease.

Meeting disappointment with triumph

Over the noon hour during the third and final day of the Porc Show, guests were treated to a culinary student competition, a tribute to Quebec’s agri-food retailers and an introduction to The Chef’s Boxmeal delivery kits with renowned Montreal-based chef Jérôme Ferrer.

After lunch, Alexandre Cusson, General Manager, Quebec Pork and Richard Davies, Executive Vice President, Sales & Marketing, Olymel took part in a brief discussion on industry issues, while Christian Bourque, Executive Vice President, Léger Marketing presented on food consumer trends.

Organizers are cautiously optimistic that next year’s event can once again be hosted in-person, but if not, the lessons learned in 2020 will be invaluable to delivering an even higher-quality experience in 2021.

While the Porc Show normally brings the world to Quebec, this year’s edition brought Quebec and Canada to the world. Extraordinary times call for extraordinary solutions, and while the virtual format is not likely the preference for most participants, it does offer certain benefits on the side of cost and accessibility. While there is no perfect substitute for the rich professional and cultural experience afforded by the Porc Show’s legendary location, the event has prevailed despite the COVID-19 crisis.