By Bijon Brown

Editor’s note: Bijon Brown is the Production Economist for Alberta Pork. He is currently working on a cost of production study for producers, to use as a benchmark for comparing profits across the value chain. He can be contacted at bijon.brown@albertapork.com.

Hog production differs regionally not only by the feed inputs used but also by the pork markets served. Looking at the current trends in the Alberta pork export market, we can examine the difference between Alberta exports and exports from the rest the country. By acknowledging those differences, we can begin to understand where Alberta producers sit relative to producers in other key provinces.

U.S. share of Canadian pork export market on the decline

Although the Canadian export market is largely dominated by shipments destined for the U.S., its relative share of the Canadian export market has declined over the past five years. From January to November 2019, roughly a quarter of all Canadian pork exports went to the U.S., down from about to 40 per cent in 2015. Meanwhile, the share of exports destined for Asia trended up to 21 per cent from 18.5 percent in 2015. The largest export market for central Canada continues to be the U.S., but Japan is the largest export market for western Canada.

From January to November 2019, western Canadian pork export volumes were about 440,000 tonnes, close to 2015 levels, but about 14 per cent below the five-year peak in 2017. Manitoba and Alberta accounted for most of the pork exports. Alberta exported more than 110,000 tonnes of pork products, down roughly 10 per cent from the corresponding period in 2018. This largely reflected a 29 per cent drop in exports to the U.S. and was partially offset by increased exports to Japan and Mexico. The decline in pork exports to the U.S. has resulted in the share of total Alberta pork exports dipping from 25 per cent in 2015 to 20 per cent in 2019. In the meantime, the Japanese share of the export market rose from 35 per cent in 2015 to 42 per cent in 2019.

Alberta exports fetch a premium in Asian markets

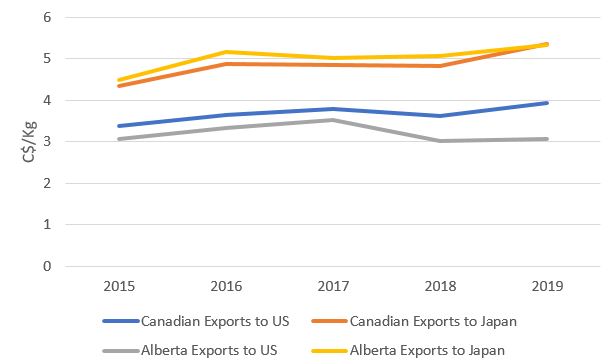

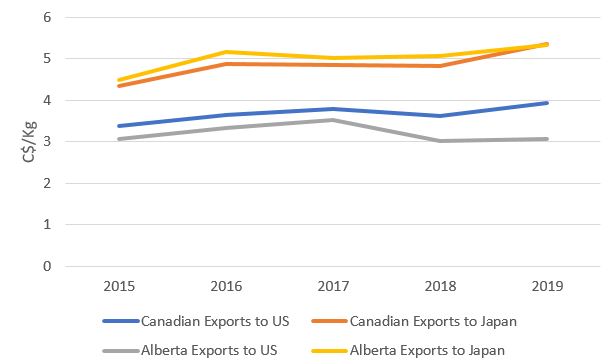

The shift towards Asian markets and away from the U.S. market has been mainly driven by economic incentives. Over the past five years, Canadian exports to Japan have attracted a premium over U.S. exports, averaging almost $1.20 per kilogram, with the Alberta export price premium averaging $1.80 per kilogram. Over the past two years, Alberta export prices for shipments to the U.S. dipped below $3.10 per kilogram from a five-year high in 2017 of around $3.50 per kilogram. Meanwhile, the average export price at the national level was $0.40 per kilogram higher, indicating that Alberta pork is being discounted in the U.S. market relative to pork shipped from other provinces. In contrast, Alberta pork shipments to Asia received a higher price than pork shipped from other provinces.

Alberta producers paid less for hogs

Despite the shift to higher valued export markets, the value of Alberta pork exports eased 13 per cent over the past five years, largely reflecting a 24 per cent decline in overall exports. In a region that exports over 40 per cent of its pork to markets paying a premium, it appears the price signals to Alberta producers have become distorted.

While Alberta pork attracts a premium, Alberta producers have seen base prices that were $0.08-0.20 less per kilogram for their hogs compared to producers in Ontario and Quebec. Currently, producers are paid a price that is derived from U.S. markets, which represents less than 20 per cent of wholesale export value. The economic realities in the U.S. market are no longer consistent with a significant portion of western Canadian wholesale pricing; it ignores the preferential premiums accessed in Asian markets.

Accordingly, farmers face lower prices, and these lower prices disincentivize investment and production. Lower prices signal that Alberta producers should reduce pork supply, which would reduce pork processed, marketed and, ultimately, exported. All this, even though there is increased demand through higher price signals coming from Asian trading partners. Prices to producers must more accurately depict prices earned downstream in the value chain. Otherwise, the inability to clearly send price signals through the value chain will leave money on the table for the entire industry, not just producers.