By Andrew Heck

Three years following the launch of the Canadian Pork Excellence (CPE) program – Canada’s new and improved hog quality assurance regimen – not all producers and provinces can claim to be on a definite path toward implementation.

CPE’s barriers to actualization were covered in the Winter 2019 and Winter 2020 editions of the Canadian Hog Journal, respectively, in the articles, “Leveraging quality assurance for better pay,” and, “Quality assurance brings value, but who pays?”

And while the program seems to be off to a running start in parts of eastern Canada, in parts of western Canada, producers have approached the program more cautiously. The hesitation is owed to a stalemate that has put producers and packers at odds: what is the program worth?

Leading the quality assurance transition

In 1998, Canadian Quality Assurance (CQA) was launched as a national standard for pork producers. Together with the Animal Care Assessment (ACA), which was introduced in 2012, these programs composed the sole unified system under which commercial hog farmers were certified prior to CPE.

Today, CQA or CPE certification is a requirement for all producers who ship pigs to any federally inspected facility in Canada. Across most of the country, that represents an overwhelming majority of pigs produced – more than 95 per cent of the total volume.

At a meeting of the Canadian Pork Council (CPC) board of directors in July 2020, an extension was granted for the recognition of CQA, which was originally slated to end entirely by January 2023. Now, the deadline has been pushed to January 2024, but that does little to advance the success of CPE. In addition, the decision was made to enable CPE validators from anywhere in Canada to train producers in any province, creating greater flexibility in program uptake.

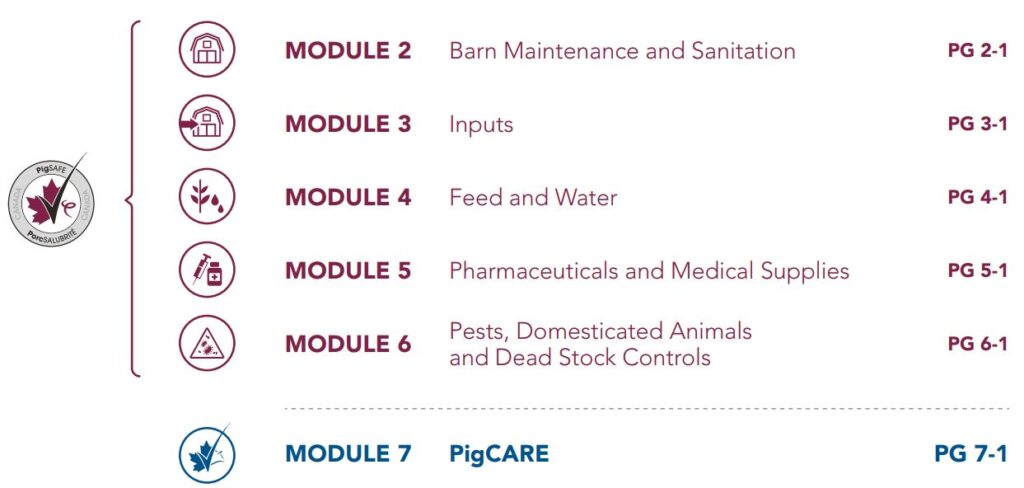

In its October 2020 report, CPC released statistics on national participation in the PigSAFE (food safety) and PigCARE (animal welfare) components of CPE. The program’s third pillar, PigTRACE (traceability), represents Canada’s ongoing system for tracking pig movements. Per the report, nearly 700 farms in Quebec and more than 300 in Ontario have been certified since the program took hold more than one year ago. In Manitoba and Saskatchewan, the program came online more recently, and those provinces count nearly 200 certified farms put together. In B.C. and the Maritimes, where few commercial operations exist, no farms are yet validated; however, that process is set to begin this year for producers in those provinces.

Western producers seek solutions

At Alberta Pork’s 2018 annual general meeting (AGM), re-affirmed at the organization’s 2019 AGM, a resolution was submitted to withhold CPE implementation in the province until producers could be promised $7 per head for all CPE-validated hogs. In Saskatchewan and Manitoba, similar resolutions had previously sought compensation, with those producer organizations ultimately moving to implement CPE by the end of 2019.

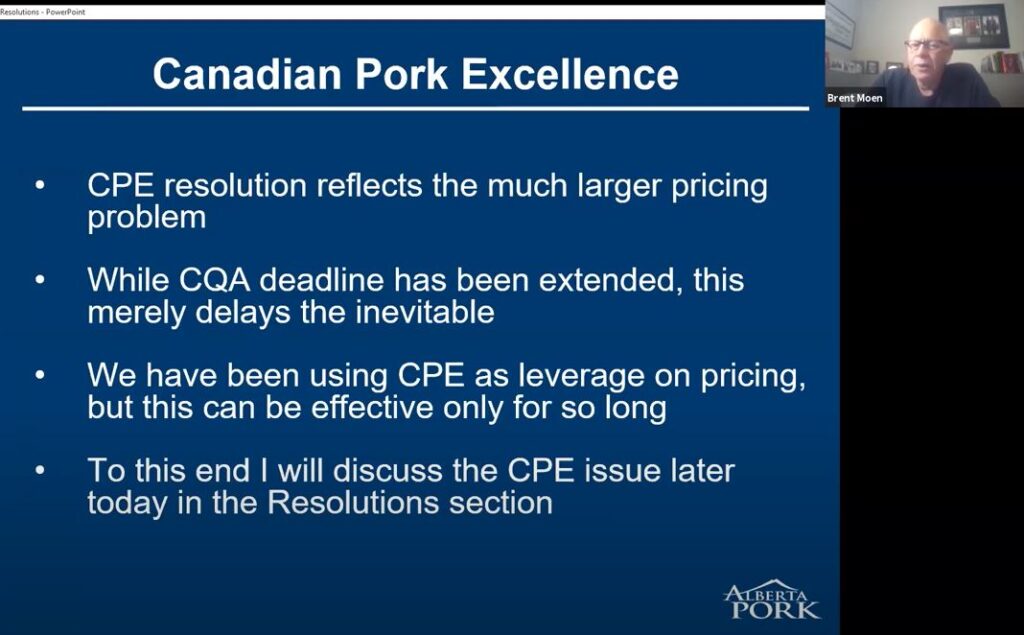

During Alberta Pork’s AGM in November 2020, the organization’s board of directors announced a decision to emphasize broader pricing solutions, rather than narrowly focusing on CPE compensation. After two years of trying, and with no movement from packers, the board felt it was more effective to transition its efforts this way.

In addition to addressing the practical realities of the situation, the Alberta Pork board of directors recognizes that producers want to continue doing their best to safeguard Canada’s food supply, while ensuring animal care remains a top priority.

“CPE is a tool that has tremendous value in the domestic and international market, and we, as producers, need to take control of this program, but Alberta Pork does not have jurisdiction to force all federal packers to pay for CPE,” said Brent Moen, Chair, Alberta Pork. “We view pricing and price data transparency as the real focus and the real problem to fix, and we will continue to work with our western and national counterparts to pursue a business case to support pricing reform, but the bottom line is that the CPE choice is up to individual producers to make.”

The rationale given for stopping work on the resolution is that, since first proposed, it has been rendered redundant, given a request made by CPC at the February 2020 meetings of both Canada Pork (formerly CPI) and the Canadian Meat Council (CMC), which receives its funding from Canadian packers, further processors and allied industries. CPC requested CMC’s pork processing members pay producers $2 per pig to recognize the increased efforts and costs producers invest into CPE validation.

CMC responded to the request by thanking producers for their work but clarified that its role is not to be “involved in price negotiations between producers and packers,” and that the request did not fall within the scope of CMC’s mandate.

Verified Canadian Pork earns a premium

In December 2019, CPC released its independently developed Made-in-Canada Hog Price Report, which took a comprehensive look at Canadian pork’s place in global markets. A notable standout is Japan, where pork of Canadian origin commands an observable premium over and above similar products of U.S. origin.

According to the report: “The Japanese premium distributed over the whole carcass would be calculated as the sum of the value of premiums on the Japanese market for each cut over the U.S. price, distinguishing fresh and frozen cuts, weighted by the share of each cut in the carcass cut-out and by the exposure to the Japanese market… The tentative estimate results in a Japanese premium of CAD $6.50 to $9 per 100 kilograms. The share of the producer is yet to be determined and should reflect the producers’ relative contribution to the effort resulting in that premium.”

CPE is the on-farm program that creates the foundation for the Verified Canadian Pork (VCP) brand, which is used to differentiate Canadian pork products sold at the retail and food service level across Canada and abroad. For packers selling fresh or frozen product in Asia, rather than just primals sold to wholesalers, the VCP logo is an important visual identifier for consumers to distinguish pork of Canadian origin.

In July 2020, Costco Japan featured an online ‘Canada Fair’ to highlight its Canadian products, including pork, for its millions of members. The webpage prominently included images of vacuum-packed spareribs and ‘Katarosu’-style pork shoulder cuts from Olymel. In 2017, the company replaced its U.S. chilled pork with Canadian pork, resulting in a 300-tonne monthly increase in sales.

This past fall, Canada Pork and Canada Beef collaborated to present a series of webinars for Japanese, Korean, Chinese and Filipino in-market importers, distributors, purveyors and end-user customers to highlight measures taken by the Canadian red meat industry to address COVID-19. The VCP program, backed by CPE, is an important part of maintaining that confidence.

Without CPE representing quality assurance guarantees at the farm level, packers would be forced to retract their CPE-driven marketing claims and implement their own programs, which may not possess the same globally recognized significance of an independent national certification program. While some packers operate integrated production and processing businesses, the goodwill behind the VCP brand would risk losing its authoritative status among overseas buyers – potentially a major problem for the entire Canadian pork value chain.

Who owns the CPE and VCP brands?

In the latest edition of Canada Pork’s merchandising handbook, the VCP brand is described as a “unique partnership opportunity between Canadian farmers, processors and retail operators seeking to differentiate themselves in the Canadian marketplace.” In western Canada, where CPE faces its biggest challenges, more than 60 per cent of all pork produced is exported. For overseas customers, the VCP brand is perceived as being “owned by participating farmers and pork processors dedicated to offering premium-quality Canadian pork, traditionally raised and minimally processed under some of the highest food safety standards in the world.”

At least officially, the combined CPE and VCP value proposition would seem to be shared by both producers and packers, even if the disparity between pork profits earned by packers and hog prices paid to producers does not always reflect that reality. In the same Canada Pork handbook, however, details on CPE specifics are few, except for an inclusion of the logo on the front cover, along with a description of the outgoing CQA program inside. Until CPE is universally implemented across the provinces, the combined brand may be forced to continue inching forward a bit awkwardly.

As such, the recognizable slogan, “From farm to table quality assurance,” becomes obviously murky in some ways for consumers. Even among value chain partners, uncertainty persists when it comes to who formally owns the brand and what that entitles them to.

Discussion has taken place at the CPC board level regarding a possible ‘licensing’ agreement between producers and packers, which would require packers to pay a fee to use the VCP brand on their pork products. The fee could act as a royalty to producers, based on packers’ pork sales. If implemented, such an agreement could help alleviate tensions between the parties, but, like per-head compensation for CPE validation, it would not adequately address the elephant in the room: shared value.

Quality assurance underscores larger concerns

Beyond CPE compensation, broader shared value discussions have taken place regarding contracts and pricing structures, and new business risk management proposals are also contributing to enhancing the producer-packer relationship.

In the past year, in western Canada, HyLife and Olymel have made beneficial changes to their contracts when it comes to recognizing producers’ efforts to raise the pigs that generate high pork profits. And since last year, producers across Canada have looked at Quebec and the province’s arbitrated marketing agreement between producers and packers as inspiration for what could be: a system that experiences market ups and downs fairly between stakeholders.

Addressing the underlying reason behind producers’ request for CPE compensation is still front-and-centre. As time goes on, will more packers come on board? One could only hope, looking at the long-term sustainability of the Canadian pork industry.