By Bijon Brown

Editor’s note: Bijon Brown is the Production Economist for Alberta Pork. He is currently collecting and analyzing cost and pricing data to improve producer success. He can be contacted at bijon.brown@albertapork.com.

When the Régie des marchés agricoles et alimentaires du Québec – the body that oversees hog pricing in Quebec – renewed the hog marketing agreement between Les Éleveurs de porcs du Québec (Quebec Pork) and the province’s packers in April 2019, the decision to include whole carcass values, cutout values and other premiums into the final price was heralded as a positive step toward producer-packer equity.

Over the course of the next two years, pig prices in Quebec have been observed with a great deal of interest by producers in other provinces, namely western Canada. When the marketing agreement was most recently renewed, many producers on the prairies were being paid decade-low prices for their hogs, so they began to ask, ‘Why not here too?’

Understanding how the Quebec pig price is broken down and how it compares to western Canadian contracts is key to determining its hypothetical effectiveness for producers outside of Quebec, using recent market data to demonstrate its application.

Breaking down the Quebec price

Although the Quebec price is not available to western Canadian producers, there is value in knowing how this price is determined and how it measures up to prices in western Canada.

The centralized marketing system in Quebec allows for a global price to be computed, and this is the price all packers in that province apply to their gird adjustments. This global price, like in the OlyWest 2021 contract, is a blend of the U.S. Department of Agriculture’s (USDA) national price, using the whole carcass report (LM_HG201) and the pork cutout value report (LM_PK602). From these reports, a U.S. window price is created, from which a Canadian window price is derived. Specifically, the U.S. window price is computed from a series of conditions:

- If the ratio of the national price (LM_HG201) to the pork cutout value (LM_PK602) is less than 65 per cent, then the ratio is kept at 65 per cent, which means that U.S. window price is 1.38 times the national price (0.90/0.65 multiplied by the national price).

- If the value of the national price (LM_HG201) is less than 90 per cent of the pork cutout value (LM_PK602) but greater than 65 per cent, then the U.S. window price is 90 per cent of the pork cutout value.

- If the value of the weighted national price (LM_HG201 plus adjustments) is between 90 per cent and 100 per cent of the pork cutout value (LM_PK602), then the U.S. window price is the national price.

- If the value of the weighted national price (LM_HG201 plus adjustments) exceeds the pork cutout value (LM_PK602), then the price used is the pork cutout value.

To establish a Canadian window price, the U.S. window price in U.S. dollars (USD) is adjusted by the exchange rate, U.S. and Canadian carcass yields and pound-to-kilogram conversion, which results in a price reported in Canadian dollars (CAD) per 100 kilograms (cKg). A CAD $2/cKg premium is added to arrive at the Quebec global price.

Table 1 shows an example of how hogs are priced in Quebec. Two of the most significant drivers of hog pricing variations across Canada are the dates and contents of the reports used in the pricing formulas. In the Quebec price example, reports dated March 15, 2021 will generate the price for March 17, 2021, while western Canadian contracts may be based on average prices of the previous week (Monday to Friday, or Friday to Thursday).

Even though some major Canadian contracts use the USDA’s whole carcass report (LM_HG201) for the U.S. national price, those packers use different components of that report in their computations. The Quebec formula uses the weighted average of the negotiated price and the ‘Swine’ and ‘Pork Market’ formula categories in the report. While certain packers may weight the price on the head count of the different categories, the Quebec price is weighted on the total carcass weight (head count multiplied by the average carcass weight).

The cutout value is the pork carcass price reported on March 15, 2021: USD $102.44/100 lbs. The ratio of the national price to the cutout value (88 per cent) determines the U.S. window price. Since the ratio falls between 65 and 90 per cent, the U.S. window price is 90 per cent of the cutout value: USD $92.20/100 lbs.

The next step is to convert the U.S. price to a Canadian price. Adjusting for the relative U.S.-Canadian yield, imperial-metric conversions (from 100 lbs. to cKg) and the USD-CAD exchange rate, the Canadian window price of CAD $234.65/cKg is computed. The quality premium of CAD $2/cKg is then added to arrive at the Quebec global price of CAD $236.65/cKg for March 17, 2021.

The reported final Quebec global price is not necessarily the price paid to producers, as this price is initially discounted and reimbursed depending on the quality of the pig.

In Table 2, the Olymel Plus 13-week average index of 111.7 is used. In Table 3, assume the producer is on the 261 Quebec Quality Grid. If the producer’s hog optimally fits the grid, an index of up to 115 can be recouped for yields between 59.6 per cent and 61.79 per cent, and weights between 87.5 kg and 119.9 kg. This means the perfect hog carcass would receive a price of almost CAD $244 (CAD $211.86 multiplied by the 115 index). However, any hog that weighs above 120 kg or below 87.5 kg, or yields less than 59.59 per cent of meat, will be significantly discounted from the Quebec global price.

Comparing the Quebec price to western Canadian prices

Quebec Pork publishes the daily global price on its website, allowing web visitors to see the posted price of all the packers in the province, including all grids and 13-week average indexes. Quebec Pork’s website is not only a hub for current data but historical data too. Data for the week of March 15 to 19, 2021 is shown in Table 4. The global price trended upward slightly over the week and averaged around $232.

OlyWest prices for this week under review were calculated based on reports from the previous week (March 7 to 13, 2021). The average price was just under $240 and $227 per hog for the OlyWest 2020 and 2021 contracts, respectively. For the Maple Leaf Foods Signature 4 contract, the review week starts on Friday, March 12 as opposed to Monday, March 15 for the Olymel contracts. Therefore, Friday, March 19 begins a new week under the Signature 4 contract. For Monday to Thursday during the week of March 15 to 19, 2021, the price was $221.04, while Friday’s price jumped to $226.26, with the start of the new contract week. The average across Monday through Friday was $222.08.

In western Canada, the index value used to adjust prices falls within lower ranges, from 107.5 to 114.89. In Quebec, this value varies for each plant as well. For illustration purposes, compare this to the Olymel Plus price in Quebec. The 13-week average index was 111.7. Therefore, a hog with a lower index will receive less than the global price. In this example, however, it is assumed that the representative hog on the Quebec grid receives the average index.

Producers on the OlyWest 2020 contract would have done much better in the week of March 14 to 20, 2021 compared to having the Quebec price. The revised OlyWest 2021 contract sits around $6 less per hog than the Quebec price and more than $12 less per hog than the OlyWest 2020 contact. The Maple Leaf Foods Signature 4 contact sits at approximately $17 less per hog than the OlyWest 2020 contract, $9.50 less per hog than the Quebec price and $4.50 less per hog than the revised OlyWest 2021 contract.

However, the revised OlyWest 2021 contract has something that the Quebec price, OlyWest 2020 and the Maple Leaf Foods Signature 4 contracts do not: a (quasi) floor base price set at $160/cKg. Barring a significant drop in the cutout price, a hog receiving the average grid grade would not fall below $177 (with bonuses) on OlyWest 2021.

Quebec price includes no premiums or freight coverage

An obvious disadvantage to the Quebec price over western Canadian contracts is that no additional premiums are available, other than the $2 premium that was built into the global price calculation. There is also no compensation for transportation costs.

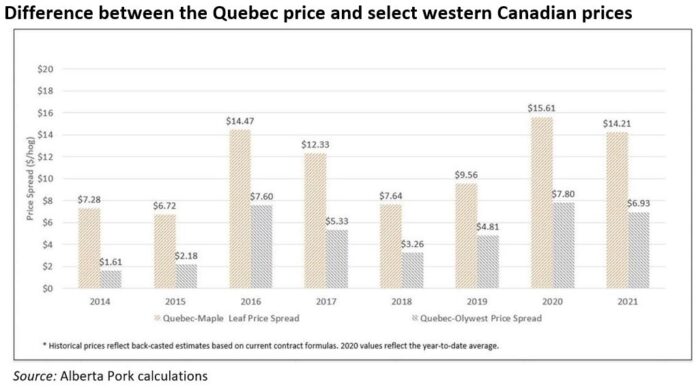

For producers whose transportation costs were more than $6 per hog, even on the OlyWest 2021 contract, they would have done better in the week of March 14 to 20, 2021 than Olymel Plus producers in Quebec, who would have still paid their $6 for trucking. Based on estimated calculations, the average price differential (the difference between the prices, also known as the ‘price spread’) would have been $5.96 between the Quebec price and the average OlyWest contract (using a simple average of OlyWest 2020 and 2021) between 2016 and 2021. This is shown in Figure 1 using the average compensation for transportation under the OlyWest contracts.

In addition, the spread between the Quebec price and Maple Leaf Foods Signature 4 contract is even more pronounced. Again, transportation would need to be deducted from the Signature 4 contract for an ideal comparison. This would increase the average spread from more than $12 to more than $18 between 2016 and 2021.

As a result of having a strong association with the pork cutout value (LM_PK602), the Quebec price has had the most appeal. However, if cash prices fall sufficiently, the producer could still face significant losses. The combination of the pork cutout value and a floor price within the OlyWest 2021 contract could be more appealing to the producer with a lower risk appetite, as much of the volatility is taken out of the price.

Pricing benefits come down to location, options

Benefits of the Quebec price versus western Canadian prices might be largely based on individual producers’ preferences and circumstances. No two producers are exactly alike, and it is important to consider the range of factors that could affect whether one price is more lucrative than other.

While some western Canadian formulas have evolved to incorporate cutout values, others are lagging behind. Producers in western Canada should rightly continue exploring their options and advocate for pricing that more equitably distributes the value of hogs between producers and packers.