By Andrew Heck

The 52nd annual Banff Pork Seminar took place at the Banff Springs Hotel from Jan. 9 to 11, featuring a wide range of plenary session speakers, breakout session presenters, award winners, research presentations, networking and much more.

“The advisory committee has worked hard to bring in speakers to cover things like the economic picture, sustainability, new technology and more,” said Steve Davies, Senior Manager, Hog Production, Maple Leaf Agri-Farms & Chair, Banff Pork Seminar Committee. “We have speakers from all over the world to cover day-to-day farm operations, to help those who want to improve.”

More than 700 guests were flooded with informative and entertaining talks on topics that spanned the pork value chain, allowing them to consider their own operations and where improvements can be found.

Markets are bleak, but future looks better

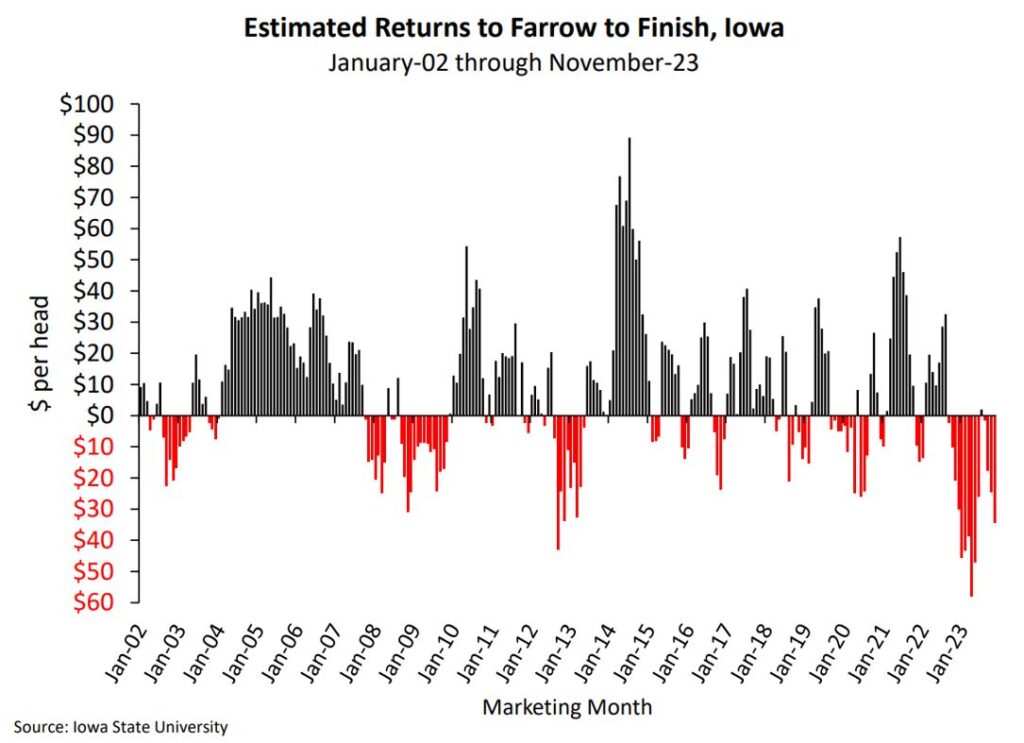

Joe Kerns, CEO, Partners of Production Agriculture opened the seminar with an exploration of commodity market outlooks for the coming year. Based on margins for U.S. farrow-to-finish operations, late 2023 and early 2024 could be considered the least-profitable for producers in the industry’s history.

While COVID-19 ultimately caused a spike in U.S. domestic pork demand, due to restaurant closures and improved grocery sales, that impact has fallen off, levelling out demand last year and likely going forward. This, along with the high cost of production but increased productivity, has hurt profitability. With inflation not easing back to pre-COVID levels very quickly, this has had a significant impact across the board. Lack of available labour remains a challenge, but the cost of labour in all industries might be an even larger problem.

However, in the coming year, Kerns believes a lot of opportunity exists, and he cautions producers against forward contracting too early.

“I could see the second half of 2024 having sharply higher prices. I’m incredibly optimistic,” said Kerns.

In virtually every pork-exporting country in the European Union (E.U.), year-over-year production continues its downward trend, making room for other market players, including Canada and the U.S. On the farm side, Porcine Reproductive and Respiratory Syndrome (PRRS) cases in the U.S. in 2023 were at their lowest numbers in more than a decade, along with the average pigs saved per litter.

These positives, however, are tempered by a less lucrative Chinese market, where pork prices have fallen rapidly in the past year on account of a large domestic supply. Whereas foreign interest in China peaked during the initial stages of the country’s African Swine Fever (ASF) outbreak, through 2018 and 2019, the Chinese government appears to be working to strengthen economic ties with South American partners.

In Brazil and Argentina, corn and soybean production are expected to be at a record high in the coming year, due to El Niño’s positive impact on growing conditions and better global market potential. Brazil has effectively doubled corn production over the past 12 years, and its soybean production continues to climb. An increasing proportion of food- and feed-grade Brazilian corn and soy is being bought by China.

“Last year will go down as a watershed moment where we [U.S.] forfeited our soybean export dominance to Brazil,” said Kerns. “They are the force to be reckoned with.”

Meanwhile, in the U.S., corn and soybeans for sustainable fuels are being pursued aggressively, cutting into supply that might otherwise enter the livestock feed market, pushing prices upward. The U.S. government is incentivizing these crops by providing a credit for farmers to sell to sustainable fuel processors.

“I think there are some unintended consequences that will be coming into play,” said Kerns.

Conestoga does things differently

Arnold Drung, President, Conestoga Meats presented his perspective on the industry as an integrated production-processing business.

As a processor, Conestoga traces its roots to the opening of its hog slaughter facility in Breslau, Ontario in 1982, along with the founding of Progressive Pork Producers in 1994: a collective formed between 120 farms in Ontario, during a time when U.S. tariffs on Canadian pork were a considerable threat to financial viability. In 2001, Progressive Pork Producers purchased Conestoga, and the two entities effectively became one.

Prior to joining Conestoga, Drung’s experiences working with Maple Leaf Foods in the 1990s share some parallels with the situation in the industry today, where the list of problems perpetually seems longer than the list of solutions.

“We ran into a train wreck in the hog industry [in 1998],” said Drung. “It was a very difficult time, with hog prices hitting record lows. That led to interesting changes, like increased consolidation.”

Worker strikes at Maple Leaf’s slaughter facility in Burlington, Ontario, along with the opening of the slaughter facility in Brandon, Manitoba, were challenges navigated by Drung that have contributed to his resiliency and poise in the face of struggle.

“It’s a great business, but it’s not for the faint of heart,” said Drung. “A key differentiator for our business has been our unique pricing model. What drives the pricing in our system is what consumers are willing to pay for pork.”

Massive currency swings, disease outbreaks and geopolitical impacts were cited by Drung as major factors that have affected Conestoga over the past 25 years.

“If you can’t compete at par, you can’t compete at all,” said Drung.

Conestoga approaches its pricing in a way that keeps the company competitive. Like all major Canadian processors, export development remains a focus for the company, though inroads have been made more recently with domestic retailers.

“Different people want different things,” said Drung. “That’s good because certain jurisdictions like different parts of the animal. That’s why we still consider the Chinese market important.”

In places like China, and in other parts of the pork-loving world, Drung suggests that economic prosperity provides hope for the future of exports.

“When people’s incomes grow, one of the things they do is spend more money on better food, including protein, like meat,” said Drung. “If you look at global incomes, they’re rising.”

Touching on the environmental sustainability of the industry, Drung sees potential for greater public awareness of the gains made so far.

“We have to keep reminding people how much we’ve already done in the past 50 years,” said Drung. “We’ve produced a lot more with a lot less, and we’re continuing to do that. People tend to forget.”

Carbon markets make sense but need work

While the agriculture industry has been reluctant to fully buy in to the principle of carbon reduction, Marty Seymour, CEO, Carbon RX suggested the sentiment is misdirected.

“Carbon, to me, is a little bit of a lightning rod,” said Seymour. “It’s an anti-Trudeau play. We didn’t like the messenger, so we didn’t listen to the message.”

Seymour’s experience working in the livestock feed industry in the 2000s saw the rise of concerns over antimicrobial use (AMU). At the time, reducing AMU seemed lofty and impractical, but with enough time and pressure, the industry is adapting.

“We could not imagine raising pigs without antibiotics in feed. Fast-forward 20 years, and we’re doing it,” said Seymour.

While the topic of carbon reduction is certainly not new, in terms of widespread adoption and implementation, Seymour thinks the best time to take the plunge is now. For agriculture businesses, it requires only an open mind and an understanding that society is unlikely to back off the idea.

“If you’re not yet at the table in this conversation, you’re not late,” said Seymour. “There’s still time on carbon, but it’s happening fast.”

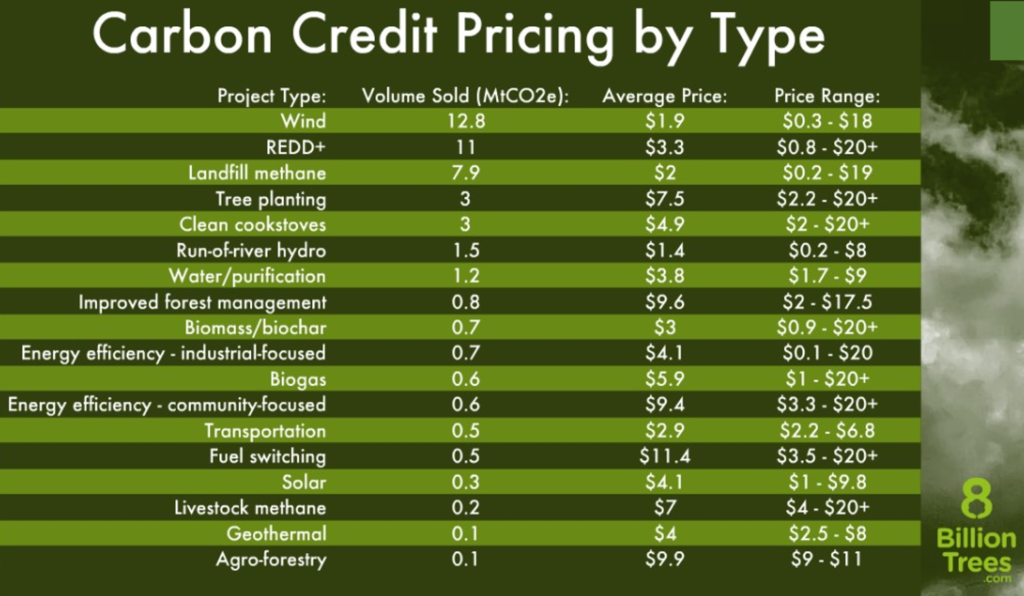

Assessing greenhouse gas intensity, methane is considered 28 times more potent than carbon dioxide, while nitrous oxide is more than 250 times more potent. For pork, that represents opportunity when it comes to manure management. Manure injection sequesters methane and reduces reliance on fertilizers containing nitrous oxide. While carbon dioxide is often the focus in carbon markets, methane and nitrous oxide are avenues that are underexplored.

Carbon markets have two types: compliance markets, like taxation, and voluntary markets, which global businesses are approaching as part of their sustainability strategies.

“This is like the Kijiji of carbon,” said Seymour.

But there’s a problem: while compliance markets are essentially unavoidable – a form of negative reinforcement to discourage emissions – they’re not integrated with voluntary markets. In many ways, this serves to lessen the attractiveness of voluntary markets. While many companies are looking to cash in on climate incentives, Seymour warns against this narrow thinking. The co-benefits of carbon reduction and meeting sustainability goals hold value in today’s commercial landscape.

“Agriculture needs to learn what ESG means [environmental, social and corporate governance],” said Seymour. “What’s changing are the financial terms related to ESG. The financial nature of carbon markets makes them a sticky business.”

When it comes to net-zero commitments, as they relate to improving public trust for the pork sector, Seymour expressed skepticism.

“I don’t think this will actually drive consumer behaviour. It’s more complicated than that,” said Seymour. “But the risk of not being in this space still isn’t worth it. If you don’t know what’s for dinner, you’re what’s for dinner.”

Heat stress concerns on the rise

Bruno Silva, Professor, Swine Nutrition and Production and Environmental Adaptation, Federal University of Minas Gerais (Brazil), thinks that global warming naysayers in the pork industry need to think harder about how to brace for a hotter planet.

“In the coming 50 to 60 years, there will be a huge impact in the northern hemisphere. Winters will get shorter, and summers will get longer,” said Silva. “It’s clear that these changes will impact our society, including economically.”

Currently, summers in Europe and Asia average about 25 degrees-Celsius for more than half of the time. This is the threshold for heat stress on sows and finishing pigs. In the U.S. livestock industry, losses to heat stress total between $1.9 billion and $2.7 billion annually.

“When we look at heat stress, it’s a cascade of effects,” said Silva.

Silva reminded producers that pigs cannot sufficiently regulate their own body heat. When pigs are too hot for too long, they experience hormonal changes. As pigs begin rapidly panting to cool themselves off, intestinal hypoxia can occur, leading to reduced amino acid digestion and inefficient growth.

Heat stress also increases sow infertility and abortions, along with worsening maternal microbial transmission to fetuses, which compromises born piglets’ immune responses. Under heat stress, microbiota modulation is key to managing sows’ glycemic response. Sows fed high-starch diets experience the effects of hypoglycemia – or low blood sugar – more intensely than those fed lower-starch diets when it’s hot.

“This is the McDonald’s effect. You order the Big Mac, the milkshake, the fries — it’s all starch, and then you’re hungry again four hours later,” said Silva.

Regardless of season, Silva suggested 80 per cent of total feed intake of lactating sows happens between midnight and 7 a.m.; however, many farms do not program their feeders for the sows’ benefit, according to this range of time, but for their own ease of management, which is less effective.

Choosing palatable feed flavours can also increase feed intake, which prevents body weight loss and stimulates milk production, partly countering the effects of heat stress. Likewise, feed formulation can play a role. Feeding less crude protein and more supplemented amino acids keeps sows cooler as they digest feed.

Prop 12 dos and don’ts

PJ Corns, Director, Sow Production, JBS Live Pork provided lessons learned in the wake of California Proposition 12: the new sow-spacing regulations that have caused some discomfort in the U.S. pork industry, as producers are left to trial-and-error experimentation, in many cases, to figure out what works and what doesn’t.

“One thing we learned in Prop 12, if you put a thin animal in the barn, she’s going to have a tough time,” said Corns.

Unfortunately for JBS, as Prop 12 compliance reared its head, the company and other producers facing the same struggles have not been assisted very proactively by the California Department of Food and Agriculture, including vague direction on exactly how pens would be measured.

When auditors visited JBS’ barns, the new set-up was already mired with difficulty, as auditors took measurements smaller than what JBS had planned for. The result was a half-square-inch less per sow, which caused headaches and necessitated further barn renovations. This prompted JBS and some of its major competitors to form a working group, to share information and resolve any common problems experienced by all.

“We had to act fast,” said Corns. “Every farm and every system we’ve done for Prop 12, we’ve gotten better.”

Corns suggested proper gilt selection, an expectation of increased labour and a change of mindset are the path to success. Sorting sows according to body condition, and then assigning pens on those factors, has helped manage the process. Not only space, but length of time in the pen, is covered under Prop 12. JBS diligently records the time sows are in pens, as an easy way to communicate compliance to auditors.

“I thought about all kinds of digital options, but nothing beats good, old pen and paper,” said Corns.

Corns also reflected on the impact of social hierarchy within the sow groups, which is even more critical to understand with loose housing. Identifying the ‘bullies’ and the ‘bullied,’ and separating them, works better for all.

On the whole, compared to pre-Prop 12 practices, Corns indicated JBS has experienced an increase in sow death losses due to injury but decreases across most other categories, especially prolapses and sudden deaths.

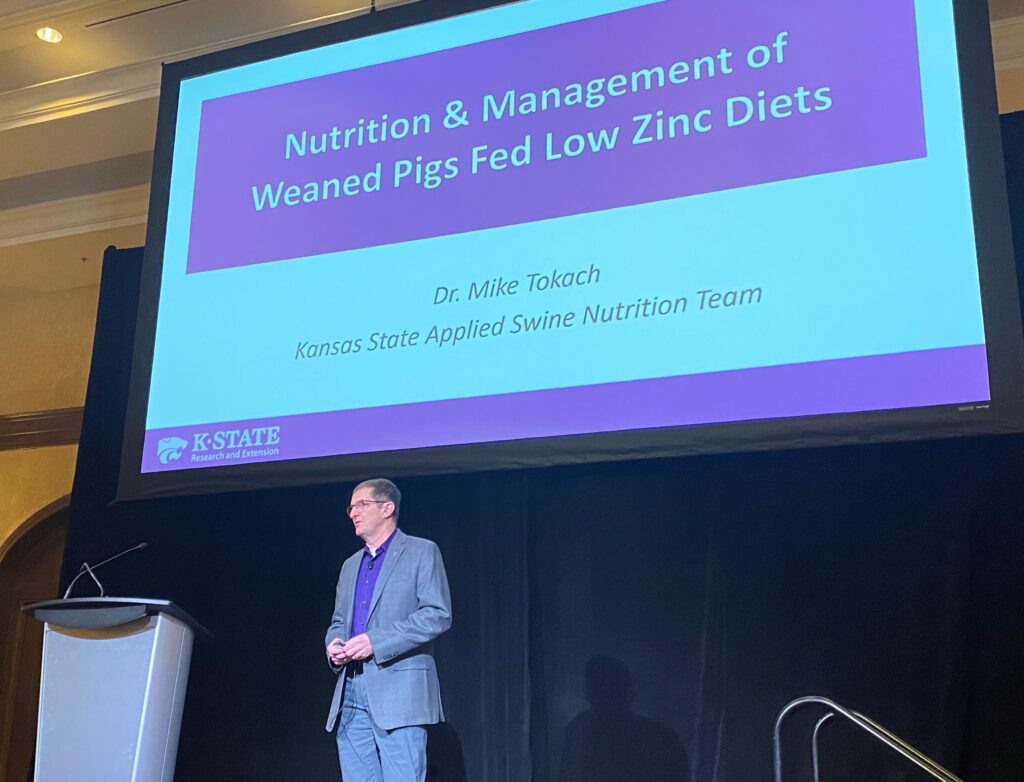

When to wean when zinc oxide is out

Mike Tokach, Professor, Kansas State University looked at nutrition and management of weaned pigs fed low-zinc diets. Zinc oxide supplements are commonly used to prevent diarrhea, but their usage globally is under growing scrutiny for their negative impacts on antimicrobial resistance and the environment.

“We know it’s being restricted in places like the E.U., and we want to prepare for a time when that could happen here [in North America],” said Tokach.

Producers around the world are now being tasked with using zinc oxide at lower levels – or not at all – while being mindful of how to overcome the loss of its benefits, using strategies related to genetics, management and diets.

Tokach suggested that lower-zinc-oxide diets need palatable ingredients that stimulate feed intake, have reduced but highly digestible crude protein and coarser-ground grains. Acid-binding capacity also matters. In the gut, products containing lactose increase calcium, which has a high acid-binding capacity. Lower-calcium diets for first two diets after weaning are recommended to help balance it out.

“In places like Denmark and the Netherlands, where zinc oxide is removed, producers are weaning at 28 days,” said Tokach.

From one genetic background to another, recommended weaning age can differ; however, early-weaned pigs have more permeability in the gut, which reduces immune response to E. coli. In general, non-Duroc genetics and later weaning ages provide the best scenario for preventing E. coli, as Duroc sires tend to have less resistance to the bacteria.

Water hardness also impacts E. coli prevalence. Water found in most parts of the Canadian prairies and U.S. Midwest is considered ‘extremely hard.’ These are areas of significant pig production where zinc oxide supplements might otherwise come in handy.

Tokach also pointed out that Rotavirus precedes E. coli in many cases, as an early warning sign. Decreasing the environmental load in the barn is important for controlling the build-up of pathogens, including Rotavirus. Effective sanitation is one solution, including a process of degreasing, pressure-washing, disinfecting and drying thoroughly at a warm temperature.

Luc Dufresne, Veterinarian, Demeter Veterinary Services took a deeper dive into weaning age, evaluating older weaning strategies to support piglet and sow performance. Deciding on the ideal weaning age, for any operation, largely depends on a cost-benefit analysis. Using an accurate production model, with good data, is essential.

“If you put garbage information in, you’re going to have garbage information coming out,” said Dufresne.

Dufresne reflected back on the popularity of segregated early weaning, which resulted unintended consequences for weaners’ gastrointestinal (GI) tracts. The GI tract is the single largest immune organ in the body. As in humans, the presence of healthy gut bacteria supports pig immunity, but earlier weaning creates stress, which disrupts the normal development of the GI tract and increases disease susceptibility, as a result.

“We used to think of the GI tract like a big stew, on an element, and whatever you put into it just mixes,” said Dufresne. “We now know that’s not how it works.”

In attempting to wean later, farrowing crate efficiency is also important. While costs will increase across many variables with later weaning, this increase is offset by reduced mortality. In Demeter’s trials, a 21-day weaning age seemed to be the sweet spot, though a multitude of production factors can come into play for individual operations.

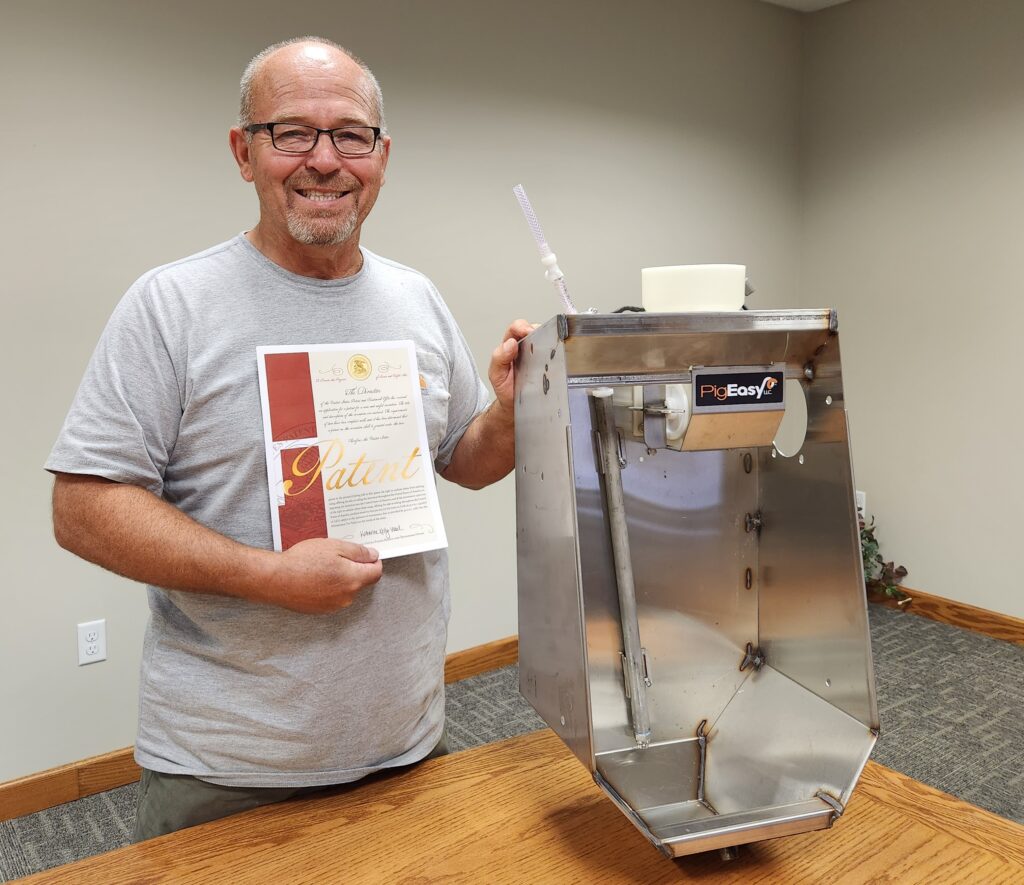

MealMeter 2.0 wins Aherne Prize

The F.X. Aherne Prize for Innovative Pork Production recognizes individuals who have developed either original solutions to pork production challenges or creative uses of known technology. The prize is named for the late Frank Aherne, a professor at the University of Alberta, who was a major force for science-based progress in the Canadian pork industry.

This year’s Aherne Prize was awarded to Iowa-based equipment manufacturer PigEasy, for its MealMeter 2.0 technology.

MealMeter 2.0 is a smart feeder designed to monitor and improve the health and productivity of sow herds. PigEasy’s system uses sensors to track feed and water intake and alerts workers in real-time via a virtual dashboard if there are dips or irregularities. This allows workers to quickly identify and treat individual sow issues. MealMeter 2.0’s dashboard tools can also help barn managers make informed decisions about ration changes, treatments and culling.

“For technology to truly improve productivity and efficiency on the farm, it must be easy to implement and user-friendly,” said Katie Holtz, Vice President, PigEasy. “MealMeter 2.0’s tracking and alerting technology achieves this by integrating into an already high-performing feeder. The PigEasy team is honoured and grateful for this recognition.”

Sows use intuitive feeding behaviors to dispense feed and water from MealMeter 2.0. With its innovative design, MealMeter 2.0 simulates the natural rooting and drinking behaviors of sows, encouraging them to consume the feed and water they dispense. There are no complicated feed curves to set, adjustments required or motors to maintain.

MealMeter 2.0 is available in Canada through Manitoba-based Buckingham Ag.

“The common-sense approach to this feeder enables the producer to have minimal electrical requirements, which dramatically reduces the cost to install,” said Rick Bergmann, President, Buckingham Ag. “The fact it doesn’t have a motor eliminates costly maintenance issues. It’s a very well thought out product that brings savings back to the farm.”

Banff’s legacy lives on

From far and wide, to the heights of the Rockies, the Banff Pork Seminar continues to represent Canada’s longest-running and one of the best pork conferences in the world, when it comes to blending informative content with networking opportunities and a stunning location.

Guests from Canada and across the globe are excited to spread the knowledge – and get the word out – about this must-attend annual event.