By Bijon Brown

Editor’s note: Bijon Brown is the Production Economist for Alberta Pork. He is currently collecting and analyzing cost and pricing data to improve producer success. He can be contacted at bijon.brown@albertapork.com.

“Listen to the whispers, not the big headlines, in the market,” said Joseph Kerns, as he opened his keynote presentation during the 2021 Banff Pork Seminar. Kerns is the President of Iowa-based Kerns & Associates, with 30 years’ experience working with producers, suppliers and feed mills to support agricultural operations.

In his presentation, Kerns provided an overview of three economic topics of interest for 2021: the U.S. grains market, the U.S. livestock market and the actions that can be done to safeguard producers’ financial well-being.

Current grain price surge reflects tight U.S. supplies

“The grain market has awakened from its slumber… For the last five years, I have been saying, ‘The grain market is boring, guys – don’t worry.’ Now I am changing my song,” said Kerns.

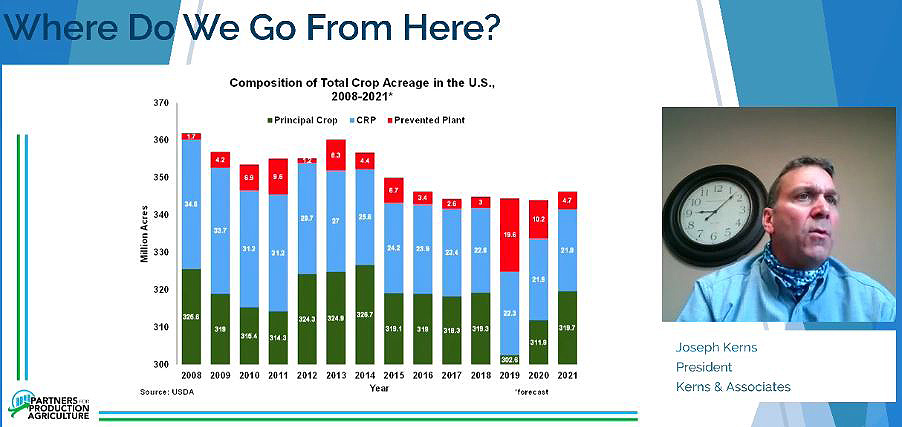

U.S. supplies of both corn and grain are limited, based on last harvest and the outlook for supplies. With the downward revision to U.S. Department of Agriculture (USDA) numbers, wind damage and drought-like conditions in the late summer to fall, corn harvest numbers in the U.S. fell to almost half of initial expectations.

Looking forward into this upcoming crop year, as dry conditions remain in the major grain-producing regions of the U.S., and with expected fulfilled sale commitments to China, supplies are predicted to remain tight. A mitigating factor is that ethanol stocks were extremely high in 2020 due to a fall in demand for gasoline, driven by COVID-19. As such, it is expected that corn demand for ethanol will remain subdued, as the market adjusts its inventory. Kerns highlighted that, even with a bumper crop in 2021, ending stocks should remain average at best, meaning prices should stay high.

And it is the same story with soybeans, which are benefiting from strong demand in Asia. This is coupled with drier conditions due to La Niña, the colder counterpart of El Niño, both of which are oceanic-atmospheric phenomena that impact weather in South America. These factors have strained global supplies and resulted in higher soybean prices.

Outlook stable for U.S. packers, grim for producers

The USDA hogs and pigs report indicated a massive number of pigs would have been due to show up for slaughter toward the end of 2020 and in the new year, but this has not materialized so far. Nevertheless, the U.S. market is awash with hogs, and packers, therefore, are able to buy cash hogs cheaply and make a decent return on sales.

Kerns indicates that packer margins are expected to remain healthy at the expense of producer profits. While revenues are expected to be higher this year, rising feed costs are expected to erode profits, and producers are expected to break even, at best. Despite another year of mediocre profits for producers, Kerns projects a slight increase in production numbers, mainly due to productivity gains. If feed costs remain high, he expects weights to decline.

Likewise, cattle producers could be looking at a bad year, as there are too many animals on feed, facing the same cost problems as hog producers. In the dairy sector, the milk futures price is below cost of production. While there were some downward adjustments to U.S. broiler chicken production in the spring of 2020, production bounced back toward the five-year high by the fall of 2020. As such, broiler prices remained below the five-year average.

China still exerts major influence on hog markets

Ever since the African Swine Fever (ASF) outbreak that decimated half of its herd, China has transitioned more of its domestic production from backyard farms to American-style mega farms. Along with the ban on feeding human food scraps, there is now and will continue to be increased demand for feed grains.

Inclement weather experienced during China’s growing season did not boost supplies and has resulted in significant draws on world grain supplies. While China’s activity in the U.S. pork market has had a muted effect on U.S. prices, global events have exacerbated activity in grain markets. U.S. exports of soybean meal and corn continue to surpass previous highs and continue to drive grain shortages.

Locking-in could help producers prevent losses

Kerns recommends that producers use the economic tools available to hedge or lock-in some value. He highlighted that the pork cut-out futures contract provides either a one-to-one hedge if a producer’s current contract is based on the pork cut-out, or a basis hedge on the difference between cash and cut-out values.

Based on his economic projections, Kerns expects some cost-push inflationary pressure, and with it, higher interest rates. He recommends that producers who have the ability to lock-in at low interest rates or exercise an interest rate swap should do so now.

What does this all mean for Canada?

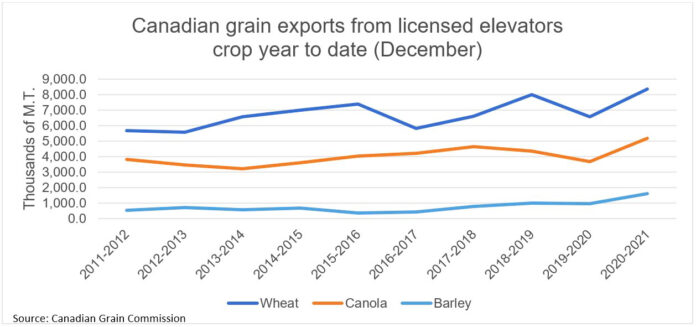

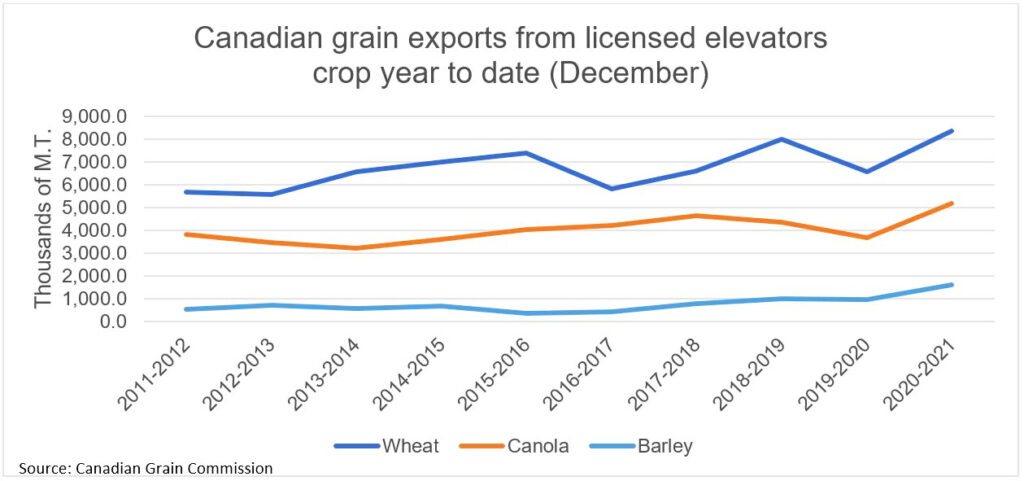

In Canada, there has been a similar trend with crop year-to-date exports for wheat, canola and barley at 10-year highs at the end of 2020. Barley exports to China have doubled, and wheat exports have jumped almost five-fold. These significant drawdowns have tightened supplies and lifted domestic grain prices. With U.S. supplies being tight, there is always the possibility of Canadian grain being pushed south of the border. Nevertheless, there was no significant movement in this regard based on the data for the crop year-to-date in December 2020.

If strong demand out of China persists and U.S. supplies continue to be tight, then this could mean grain prices remain elevated for the foreseeable future. Like U.S. hog producers, it is expected that Canadian hog producers’ revenues could be eroded by the higher cost of feed, despite the possibility of higher hog prices.

While publicly available hog and pork pricing data from Canadian packers is limited, Canadian pork export data indicates that revenues have jumped by almost 18 per cent. While, historically, the U.S. was once the largest export market for Canadian pork, 2020 bucked the trend, as most Canadian pork was diverted to the meat-deprived Chinese market. In 2020, nearly 40 per cent of Canadian pork exports went to China, more than double the volume in 2019. The growth in 2020 resulted in marginal declines in exports to both the U.S. and Japan.

Overall, the previous two years of Canadian pork export values and volumes, along with projections for 2021, indicate significant boosts to packer revenues, while producers have struggled to recover cost, let alone earn a profit.