By Mark Fynn

Editor’s note: Mark Fynn is Training Resources Coordinator, Canadian Pork Council (CPC). He can be contacted at ‘fynn@cpc-ccp.com.’

After nearly a decade of work involving more than 200 contributors, the Canadian Pork Council (CPC) has introduced PigLEARN: an online training platform designed to enhance skills and boost productivity in the Canadian pork industry. It offers a flexible, self-paced learning experience with a wide range of educational content, training modules and valuable resources.

The PigLEARN story is a proud example of how the sector came together to build something meant to last. Its platform and training are a culmination of efforts to develop the content that is now housed within PigLEARN. Thanks to input from across the sector, PigLEARN is now available to producers and industry partners all over Canada!

What does PigLEARN offer learners?

With PigLEARN, learners can track their progress and receive recognition for their achievements, empowering them to stay current and excel in their roles. The platform offers an administrative portal for organizations and companies to manage their own trainees, as well as a simplified portal for workers to log in and complete their assigned training.

The platform currently hosts 96 training modules developed by producers and other pork sector experts on a wide range of topics, including:

- Animal-based measures

- Biosecurity

- Enhanced biosecurity for disease outbreaks

- Euthanasia

- General farm tasks

- Group sow housing

- Growing pigs

- Pig handling

- Preparing to transport pigs

- Sow barn tasks

- Veterinary products

The full, detailed catalog of 96 modules can be found on the Canadian Pork Council (CPC) website at cpc-ccp.com/piglearn. Another 20 modules on worker health and safety are planned for release in early 2027.

The training modules aren’t just videos either; they feature advanced simulations and real-world scenarios to prepare workers for the barn. These come in the form of visual and interactive knowledge checks, which use a variety of question formats and approaches.

To ensure the platform was accessible for the sector’s diverse workforce, PigLEARN features narration in English with Spanish, Tagalog (Filipino) and Ukrainian subtitles, and narration in French with Spanish subtitles.

What does PigLEARN offer companies?

Beyond the many training modules, PigLEARN offers administrative abilities for companies to manage, track and incentivize the training progress of their workers. Company administrators can:

- Brand the platform with their company’s logo and colour scheme to truly make it their own.

- Create their own custom training content through the platform’s module builder, including drafting their own text and quizzes, and uploading their own videos, PDFs and presentations.

- Build and assign their own custom learning pathways, which can compile any combination of their own custom modules and PigLEARN pre-built modules.

- Register and manage their own workers, grouping them by work area or any other attribute and assigning them customized learning individually or by group.

- Track training progress of individuals within the platform or by exporting a CSV spreadsheet for potential integration with other software.

- Generate customized certificates with specific completion criteria that will be automatically granted to learners when they complete lessons.

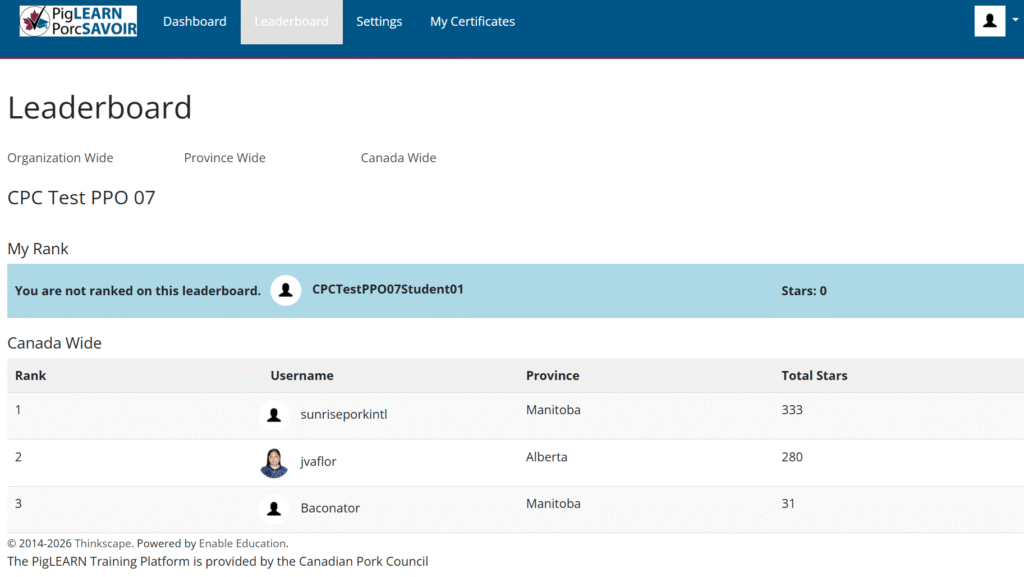

- Promote healthy competition through the optional leaderboard function, which allows users to decide whether to share their achievements with other learners in the company, their province or the whole country.

How was PigLEARN training developed?

Historically, pork producer training resources were developed independently in each respective province; however, in the late 2010s, provincial pork organizations noticed a fair amount of redundancy between what each province was developing. On top of that, it was hard for each province to devote much staff time to training development. Collectively with CPC, the sector discussed the possibility of pooling time, talent and funding nationally to develop high-quality training resources informed by expertise from across Canada.

In 2019, CPC received federal funding for a multi-year training development project. The project began with a steering committee meeting of pork producers, veterinarians and other pork sector experts, whose task it was to decide which training topics to prioritize first. Year one of the project focused on biosecurity, humane transport and euthanasia. Each topic area required its own working group of five to 10 people from across Canada with expertise in that specific area. The first three working groups were established by early 2020.

Although the idea of a PigLEARN training platform was floating around since the beginning of the project, it wasn’t decided on until 2022. CPC partnered with Enable Education from Milton, Ontario to develop and host the platform, using training videos previously developed collaboratively with Prairie Swine Centre (PSC), Centre de développement du porc du Québec (CDPQ), and Équipe québécoise de santé porcine (EQSP). The contributions of PSC, CDPQ and EQSP were foundational to developing the platform, which was officially launched in March 2025.

Since launching, another seven working groups started and completed work on different topics, bringing the total number of PigLEARN training modules to 96 and counting.

Kudos to the working group members who have devoted and continue to devote time and effort above and beyond their already full-time schedules. They are involved from conception to completion, including reviewing content outlines, scripts, videos, knowledge checks and finalized modules.

How can learners register on PigLEARN?

To register on PigLEARN, or to find out more information, contact your provincial pork organization. Although CPC would love to offer the platform to producers for free, it is important the platform be sustainable.

The intent of PigLEARN is not to make a profit but to build and maintain a safe and skilled workforce today and into the future. Subscriptions are priced so the platform runs cost-neutral, ensuring it can be maintained, and that new or updated modules can be added regularly.

The main subscription option is a 12-month subscription that gives someone full access to complete all PigLEARN training modules (and any company-uploaded modules) for $51.25 plus tax. Another option for companies who want to use the platform to provide company-uploaded training only to certain workers is a 12-month subscription for $15.38 plus tax, but these workers will not have access to any of the PigLEARN training modules. Subscriptions are only required when someone tries to view the training content. Companies can still log into the platform for free to complete administrative tasks, and learners can log in for free to see what is available as well as their past training achievements if their subscription expires.

PigLEARN is a testament to industry collaboration

The strength of the Canadian pork industry shines when we work together – no turfiness, no ego. PigLEARN is a proud example of how the sector can come together and built something to last.

PigLEARN’s platform and high-quality training involved the efforts of many people and years to see it come to fruition. Thanks to input from across the sector, PigLEARN is now available to producers and industry partners across Canada.

Winter 2026 edition is here!

The Winter 2026 edition of the Canadian Hog Journal is here!

Find these articles and more:

For all editorial and advertising inquiries, email ‘andrewtheck@gmail.com.’

For any new, updated or cancelled subscriptions, email ‘rawya.selby@albertapork.com’ or phone ‘780-474-8288.’