By Andrew Heck

The Canadian pork industry is only as strong as its least-appreciated asset: producers.

Business continuity is currently under threat due to a host of issues in the industry, and underscoring the struggle is a lopsided relationship between producers and packers, which is further slanted down the value chain at the retail level. Consumers often do not see this, and it remains far too easy for them to ignore that reality when food continues to fill their plates.

Research from the Canadian Centre for Food Integrity (CCFI) shows that the Canadian public trusts farmers, even if many non-farmers are not always up-to-speed with how the agriculture industry operates. As such, producers have earned a significant amount of respect from many people who are simply not aware of the financial dynamics at play. Even among producers, interpreting the dollars-and-cents paper trail can seem like a bit of a shell game.

Addressing long-term viability – specifically independent producer profitability – requires certain challenges to be brought to light for the betterment of all partners. With the decade-low prices seen in September 2018 and similar prices in April 2020, many producers are still stuck in multi-year contracts with packers. As it stands, some producers have been and will continue to make a departure from producing pigs altogether before losing more of their equity.

Coming together for the greater good

In mid-May, the pork producer organizations in B.C., Alberta, Saskatchewan and Manitoba issued a joint invitation to executives from Maple Leaf Foods, Olymel and Donald’s Fine Foods to have an open and frank discussion on the state of the industry, and to work for solutions that generate shared value for producers and processors.

Part of the written invitation reads: “As a result of our flawed value sharing system, pig producers in Canada have needed to rely on the goodwill of the federal and provincial governments and taxpayer dollars to support producers’ very survival.”

It continues, “For too long, the producer and packer have been at odds with each other, and it has created an unmanageable and antagonistic relationship that is weakening the industry and the brand in the global marketplace. This approach must come to an end.”

Shortly after the letter was sent to packers, notice was given to the broader Canadian pork industry and news media. Following the wider distribution, David Duval, Chair, Les Éleveurs de porcs du Québec (Quebec Pork Producers) expressed his support for the initiative:

“This is a very legitimate request that espouses our concerns that we have repeatedly expressed to our partners in Quebec. Sharing the price according to the real value of pork on the markets is a critical issue, both for the sustainability of pork producers and for buyers.”

With the COVID-19 pandemic highlighting some of the stress points in our value chain, producers are eager as ever to work on solutions. With limited options at their avail, many producers are feeling cornered by the lack of incentive to grow their businesses. The resulting stalemate can be considered a huge lost opportunity for everyone.

Processor profits helped by narrow producer margins

Réjean Nadeau, President & CEO, Olymel, in his company’s most recent annual report, stated: “The Western hog production sector recorded a loss in 2019 almost equal to that of the previous year despite the favourable impact of a weaker Canadian dollar. The loss stemmed primarily from lower livestock prices and higher grain costs.”

While that is no shock to producers, on the meat side, the story was different: “In 2019, the Western fresh pork sector recorded improved results for the fifth successive year despite the suspension of the Red Deer plant’s export licence for China. This solid performance was driven primarily by a higher meat margin stemming from the increase in slaughtering volume and a greater share of value-added products.”

Olymel’s strategic targets, as indicated by the company’s strong push for overseas market development, are largely dependent on a reliable, increasing supply of hogs for its plants. Olymel operates four hog slaughtering facilities in Quebec and one Alberta. Aside from a two-week span in mid-April, during which time one plant was temporarily shuttered after several workers contracted COVID-19, Olymel typically cannot get enough hogs to satisfy existing capacity and new growth.

In Alberta and Saskatchewan, Olymel’s integrated 50,000-sow production accounts for more than 60 per cent of what is shipped to its plant in Red Deer. Factoring in everything else Olymel contracts or buys, the company owns most hogs on-farm in Alberta, effectively controlling the largest proportion of available supply.

The highly skewed nature of producer-to-processor leverage, in favour of processors, places producers in the difficult situation of having only two prominent hog buyers dominating the market. It is a precarious position for those who may feel powerless to break the cycle of disadvantageous contract negotiations.

Further complicating the situation is the difference between production levels and profits in western and eastern Canada, which translates into a disparity between what producers are paid in Alberta and Saskatchewan versus Quebec.

Olymel is a division of La Coop fédérée, now known as Sollio Groupe Coopératif. The cooperative is composed of more than two dozen localized traditional agriculture networks in Quebec, to which thousands of hog producers belong. In 2019, Sollio distributed $17.6 million in patronage refunds to cooperatives and paid a $2.4 million dividend to the Cooperative Pork Chain.

In addition, for those who raise hogs in Quebec, the provincial Farm Income Stabilization Insurance (ASRA) program provides an added competitive advantage by acting as a form of collective insurance to protect against market and production cost fluctuations. Complementary to the federal AgriStability and AgriInvest programs, ASRA pays compensation when the average selling price is lower than the stabilized income. The stabilized income is based on the production cost of specialized farm businesses.

In western Canada, there is one saving grace for producers who sell to Olymel: a transport proximity bonus, introduced in mid-2019, that helps off-set the cost of shipping to Red Deer. Additionally, the company has recently widened its grids to accept larger hogs, introduced incentives for group sow housing and provided new futures-based forward-contracting options. While these perks have helped sweeten the pot for some, many producers are still seeking options for mutual prosperity.

Olymel asks to revert Quebec pricing decision

Among the potential solutions that could help producers across Canada is a pricing structure that takes into consideration cut-out values, such as the model in Quebec.

Despite having established a new pricing model for that province less than two years ago, Olymel appealed to the Régie des marchés agricoles et alimentaires du Québec (the province’s commodity marketing council) in early Marchto suspend the use of the existing price formula for a four-month period, on account of the COVID-19 pandemic, citing short-term processor losses.

Olymel’s request was for a return to a combined formula taking 75 per cent of the previous structure while maintaining 25 per cent of the current structure outlined in the province’s 2019 to 2022 Marketing Agreement. Les éleveurs de porcs du Québec (Quebec Pork Producers) quickly opposed the decision, which would have slanted the tables back to less equitable pre-2019 times.

Quebec Pork’s opposition was based on Olymel’s lack of a comprehensive proposal that would help reduce surplus pigs – a key issue at the time of the request. In the interest of fair risk sharing, Quebec Pork offered a temporary fallback proposal, which involved a 50 per cent calculation combining the two pricing formulas.

The rationale for the temporary decision was largely based on Olymel’s arguments: destabilization due to COVID-19, including the Yamachiche plant’s two-week shutdown and consequent retrofitting measures required for workers, caused harm to Olymel’s slaughter margins and would have further affected meat-cutting. While such measures equally impact those who raise pigs, the suggestion of a combined formula disappointed producers.

In early June, following a series of hearings, the Régie overturned the temporary 50-50 split, favouring a reversion to the pre-COVID structure. The decision, however, adds a condition that prevents the hog slaughter price from falling below 65 per cent of the cut-out price. In May, the price disparity resulted in record-high payouts to producers. Further hearings to review the decision are scheduled for July, August and September.

Going green while producers are in the red

Sustainability in the pork sector can mean different things to different people. For consumers, the word often conjures up impressions of eco-friendliness. But for producers, business continuity is the primary focus when margins are tight.

In November 2019, Maple Leaf Foods made the announcement that its organization had become the first major food company anywhere in the world to achieve carbon neutrality through the purchase of carbon offsets in addition to processing plant upgrades. As a result, in December 2019, Maple Leaf received a $2 billion loan from BMO as a sustainability incentive. This type of “green lending” is gaining traction in Canada as motivation for companies to lower their carbon footprint.

In January 2020, Rory McAlpine, Senior Vice President, Government and Industry Relations, Maple Leaf Foods, suggested during the Canadian Agricultural Economics Society policy summit in Ottawa that competitiveness is an issue for processors. Environmental regulations, carbon pricing and other factors have hindered growth compared to Canadian processors’ American counterparts. While the argument may hold water in a direct comparison, Maple Leaf’s $600-million chicken processing facility under construction in London, Ontario, announced in November 2018 – which is receiving more than $50 million in combined funding from the governments of Ontario and Canada – may also suggest a discrepancy in that line of reasoning.

With the release of Maple Leaf’s latest annual report, Michael McCain, CEO, stated: “At Maple Leaf Foods, we have embraced the principle of shared value and are on a purposeful journey to become the most sustainable protein company on earth… We believe our company’s financial health and competitiveness are intertwined with the health of local, national and global communities.”

He added, “For the year, our meat protein segment delivered 10.4 per cent adjusted EBITDA margins, up 50 basis points over the prior year, while absorbing the impact of difficult and unnaturally volatile market conditions which produced headwinds of 110 basis points. This speaks to the underlying strength of the business.”

Maple Leaf’s pursuit of shared value, while noble, may appear to conflict with its ambitious growth strategy. And while growth is no sin in the business world, the consequence may be that producers are no longer able to compete.

Contracts demystified using new tools

For the average producer, making heads or tails out of contract specifics can be a nightmare. For those signing the contract without a full disclosure of straightforward information, what appears to be a win-win deal can end up hurting producers by locking up their hogs at an unfavourable price. Market volatility is the name of the free market capitalism game, but not every party is necessarily equipped to fight fairly.

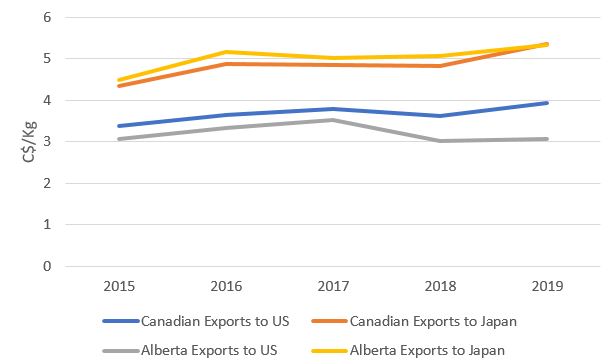

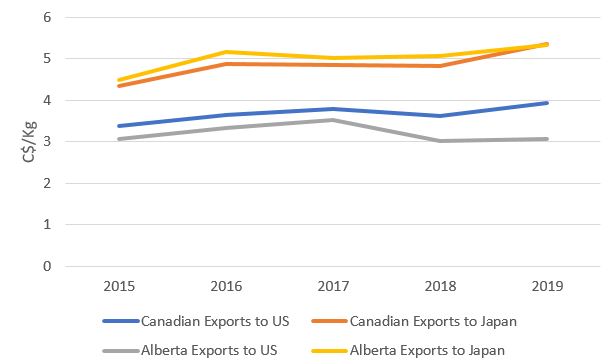

In early May, Alberta Pork published on its website a new Economics section designed to support producer success by providing the tools for effective contract decision-making. The section includes pork market and hog supply reports, information on cost of production and the latest economic research, in addition to pricing formula breakdowns for western Canada’s federally inspected processors.

“COVID-19 has changed our world, and it is now time to fix the main issue that hampers the Canadian pork industry,” said Darcy Fitzgerald, Executive Director, Alberta Pork. “Producers are simply asking for a system that gives them a financial reason to produce pigs. The catalyst for change is transparency, and it starts by placing as many cards on the table as possible. With the problem fully laid out in the open, it becomes more difficult to avoid solutions that are beneficial to both parties.”

Following on that work, Alberta Pork teamed up with the Canadian Pork Council (CPC) in June to develop a pricing calculator to allow producers to use their own numbers for evaluating various contract options.

“The calculator will provide an important opportunity for producers to consider adjusting their businesses, according to any marketing options they might have in the future,” said Phyllis MacCallum, Sector Analyst, CPC. “With the help of this new tool, we hope to strengthen producer leverage and encourage further work toward a fairer, more accurate pricing structure for all Canadian pork producers.”

The calculator will use pricing formula data compiled in-house by Alberta Pork, based on U.S. Department of Agriculture (USDA) mandatory reporting, which is also the basis for Canadian prices. Producers can enter their own information, which then creates a hypothetical comparison between contracts for most western Canadian packers and Quebec. The goal is to eventually include options for additional packers, including those in Ontario.

Donald’s pursues unique opportunities

It can be challenging to serve niche markets, with an Asian focus, while having to rely on a largely out-of-province source of hogs, but Donald’s Fine Foods has risen to the occasion for more than two decades.

Starting in the late-1990s, Donald’s made significant investments to grow Britco Pork – an acquisition that helped transform the company from a humble Lower Mainland meat cutter into an up-and-coming heavy hitter in western Canadian pork processing.

In 2005, Donald’s meat-cutting facility in Richmond, B.C. was commissioned, followed by the purchase of Thunder Creek Pork in Moose Jaw, Saskatchewan in 2010, along with the launch of the Sakura Farms brand in 2012 and the purchase of Five Corners Meat Co. in 2017.

The province of B.C. is home to only a handful of commercial producers, making hog supply a challenge for a company looking to maintain – let alone expand – its operations. As such, Donald’s today relies extensively on Alberta producers who ship to its slaughter plant in Langley.

It can be a perilous trip across the Rocky Mountains, no less than 1,000 kilometres for the closest producers in Alberta, and while new transport regulations have been a learning curve, Donald’s maintains its commitment to producers by fully covering transport costs and pricing pigs to match the Maple Leaf Signature 4 formula.

In late May, Donald’s undertook an eight-week study to determine the viability of converting a former beef plant in Moose Jaw into a sow processing facility, to complement its operations at the nearby Thunder Creek plant. The study is considering the financial feasibility of such a conversion, in addition to overall support from producers, the public and government.

“[This] announcement is the first step toward a strategic investment to meet the demand for domestic sow processing,” says Allan Leung, CEO, Donald’s Fine Foods. “We want to create more opportunities for pork producers and support the forecasted need for domestic sow processing capacity.”

Thunder Creek will continue to operate independently, and the jobs created from the sow processing facility would be entirely new. The new plant is anticipated to employ approximately 100 people, with the capacity to process most cull sows in western Canada. Currently, producers export over 80 per cent of their cull sows to the U.S.

HyLife steps up to the plate

As producer organizations continue to lean on packers for support, one stands out in terms of its progressive efforts to strengthen relationships: HyLife. In April, the company introduced new premiums to reward producers, including a bonus for hogs validated under the Canadian Pork Excellence (CPE) program, in addition to weight- and ration-based incentives.

Like other counterparts in Canadian pork processing, HyLife is undertaking ambitious steps to grow business. In early May, the company announced the acquisition of more than 37,000 sows and 250 employees after purchasing ProVista’s hog operations.

“We have a long working relationship with ProVista and look forward to building on all the hard work that they have done,” said Grant Lazaruk, President & CEO, HyLife. “This acquisition enables HyLife to expand our production team and secure hog supply to facilitate future growth.”

In late May, HyLife further grew its capacity and employee base by purchasing a 75 per cent equity interest in Prime Pork, a recently renovated facility that produces, processes and sells pork products out of Windom, Minnesota, southwest of Minneapolis. Prime Pork raises 300,000 feeder hogs to market weight annually and sources the remainder from third-party suppliers. The newly acquired plant currently processes one million hogs annually, on a single shift. The company’s main processing facility is in Neepawa, Manitoba, northeast of Brandon, where they process 3.2 million pigs annually.

While HyLife shares its competitors’ growth desires, the company appears to be taking calculated, considerate steps toward expansion with independent producers’ interests in mind, helping to augment the company’s integrated operations – a refreshing situation for everyone.

All parties must cooperate to move forward

As the 2020 calendar year stumbles along in often unpredictable ways, flaws in the Canadian pork supply chain’s shared value approach are being made more apparent than ever.

The COVID-19 pandemic did not cause the issues inherent to the pork sector when it comes to pricing and capacity. However, the pandemic has highlighted in a very powerful, public way the vulnerabilities that exist within our system.

In terms of ensuring the viability of that system in the future, it will need to adapt. In terms of cultivating a positive reputation for our sector, all parties will need to cooperate and present a united front to retailers and consumers. Transparency is key.

Producers and the industry cannot wait any longer for change. The ball is now in the packers’ court. Who will accept the challenge, and who will dismiss it? At this point, it is not a matter of discovery and understanding, but action.