By Lexie Reed

Editor’s note: Lexie Reed holds a Doctor of Veterinary Medicine from Ontario Veterinary College. She can be contacted at lexiereedvm@gmail.com.

Pork-associated human illnesses have drawn unfavourable media attention to the swine industry over the years. In 2018, a pork recall was issued by the Canadian Food Inspection Agency (CFIA) in response to an outbreak linked to an Alberta restaurant. The pathogen responsible for the death of one individual and more than 40 cases of illness was Escherichia coli (E. coli) O157:H7.

As few serious E. coli illnesses have been associated with pork products, there was skepticism that contamination from cattle in the abattoir was truly to blame for the outbreak. However, a 2020 study found that O157:H7 bacteria reside within the intestinal tract of pigs, and though risk of E. coli illness from pork products is low, it can have serious consequences.

Fecal contamination of hog carcasses is a serious risk factor for foodborne illness from pork. For these reasons, cooking pork thoroughly is recommended to kill any bacteria that may be present on the meat. Hygienic removal of the intestines post-slaughter, to prevent the spillage of intestinal contents onto the saleable carcass, is another important step.

But what if there was another layer to the pork safety net?

The need for E. coli antibodies

A 2017 study of provincially licensed abattoirs in Alberta found that 1.8 per cent of carcasses sampled were contaminated with O157:H7, several of which were subtypes of O157:H7 that are of importance to human health. Samples were taken from abattoirs that slaughtered both pigs and cattle and from abattoirs that slaughtered pigs only. No difference in the prevalence of O157:H7 carcass contamination was observed between abattoirs that slaughtered just pigs or pigs and cattle, indicating that O157:H7 contamination of hog carcasses is a result of the pathogen occurring within the pigs themselves.

O157:H7 antibody technology was originally proposed for development in cattle, as O157:H7 contamination is predominantly associated with ruminants. However, the efficacy and safety studies in mice are more applicable to monogastric species, and thus the development in pigs was pursued. Success in monogastric studies may still lead to the development of direct-fed O157:H7 antibodies to cattle.

Developing an E. coli antibody to feed pigs

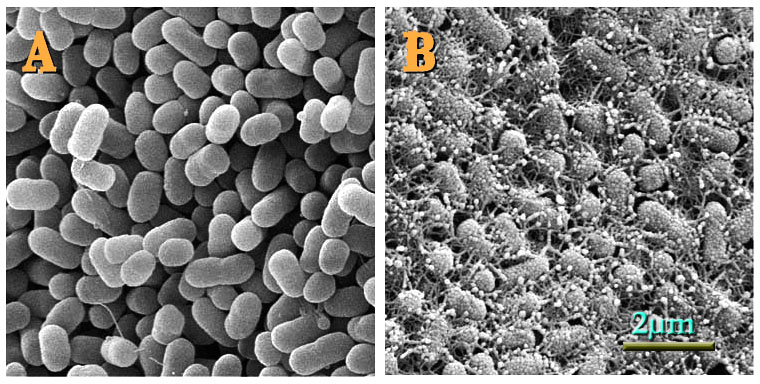

Agriculture and Agri-Food Canada (AAFC) research scientists have recently isolated an E. coli antibody that could neutralize O157:H7. The antibody is synthesized within the plant Nicotiana benthamiana and could be delivered as an edible feed material. Once ingested, the antibodies would bind and neutralize O157:H7 present in the gastrointestinal tract.

Rima Menassa is a genomics and biotechnology research scientist at AAFC’s London Research and Development Centre. She conducted the study that found the antibodies to be effective at neutralizing O157:H7 in cell cultures. Presently, Patti Kiser of Western University is conducting a study to determine if the direct-fed antibody can neutralize O157:H7 in mice, which would bring the technology one step closer to proof of concept in livestock.

“If feeding the antibody to mice who already have O157:H7 established in their intestines prevents shedding of the pathogen, then antibody feeding short-term prior to slaughter could be an option in pigs,” said Menassa. “If, however, the antibodies only prevent O157:H7 from colonizing the intestinal tract when it is introduced to naïve mice, then it is more likely that the antibodies would need to be fed from an early age, before significant O157:H7 exposure.”

If successful, the outcome of the study could lead to commercialization of the technology. Preventing E. coli from colonizing the gastrointestinal tract or reducing shedding of the pathogen would reduce the risk of O157:H7 contaminating the carcass at time of processing. Further, this technology could reduce the risk of contaminated manure, which may be spread on crop fields as fertilizer.

The plant used to produce the antibody, Nicotiana benthamiana, is a plant related to tobacco, native to Australia. It is commonly used for molecular biology studies and has been used to produce vaccines and other pharmaceutical products, thanks to its natural ability to express foreign gene sequences.

Although the dose regime has not yet been established, it is unlikely that the amount fed of the plant material would contribute any appreciable nutritional or fibre content. The current study in mice will explore both efficacy and safety of the plant-encapsulated antibodies. The results of this study will also help to establish a timeline for feeding pigs pre-slaughter. This study is a collaboration between AAFC and PlantForm Corp., a start-up plant biotechnology company based in Guelph, Ontario.

Direct-fed antibodies have a future

Though still in its infancy, direct-fed antibody technology is on the horizon. The commercialization of this technology for O157:H7 could expand to other significant zoonotic pathogenic bacteria in pigs, providing abattoirs with another mechanism to reduce foodborne illness from pork that starts before the pigs even reach the packing plant.

Even beyond a food safety application, this pharmaceutical delivery system could create a new avenue for vaccine and antibody delivery through feed, particularly at a time when barn labour is a significant challenge for many producers.

Whether or not an E. coli O157:H7 antibody for pigs is embraced as a method for preventing foodborne illness from pork, the development of a novel delivery method for antibodies could be a breakthrough product for the swine industry.