By Bijon Brown

Editor’s note: Bijon Brown is the Production Economist for Alberta Pork. He can be contacted at bijon.brown@albertapork.com.

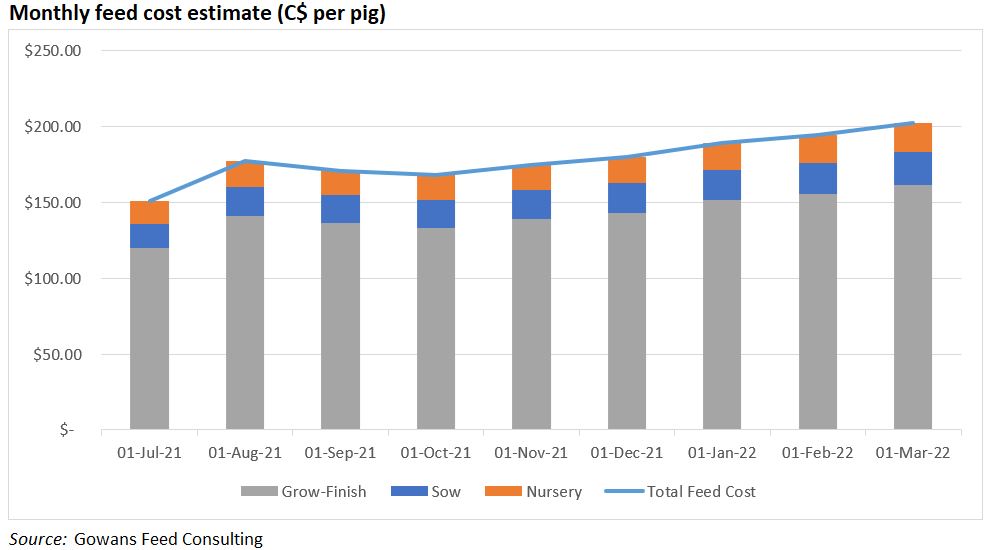

High feed prices seen today have resulted from a combination of local and global events. By understanding some of the major factors that are currently affecting feed supplies and pricing, risk mitigation may be possible.

From the war in Ukraine, to moisture conditions across the Americas, to international trade relationships, feed prices have remained the number-one concern for livestock producers for more than a year, and this looks to be the case in the coming months.

Ukrainian infrastructure damage causes concern

Along with the tragic and significant loss of life since the war in Ukraine began earlier this year, the movement of grains and other commodities has been challenged by damage to critical infrastructure and the closure of seaports.

Ukrainian grain exports in March were a quarter of the volumes reported in February, with only 1.1 million tonnes of corn, just over 300,000 tonnes of wheat and almost 120,000 tonnes of sunflower oil moved to export destinations via rail.

The closure of ports has caused significant backlogs and bottlenecks on rail corridors and has dramatically increased the cost of moving grain out of Ukraine. According to the United Nations’ Food and Agriculture Organization (FAO), this conflict has fueled a marked increase in the price of sunflower oil globally.

South American drought ravages soybean crop

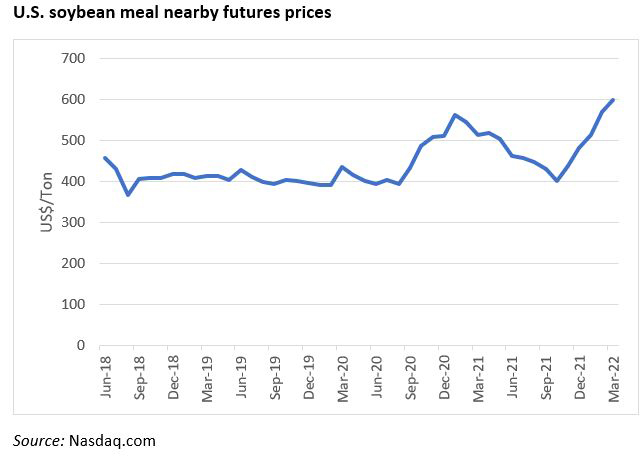

Dry conditions have devastated crop yields in South America recently. Brazil’s soybean crop is expected to fall below 120,000 metric tonnes for the first time three years. The drought has been felt not only in Brazil, with soybean production projected to be down nine per cent in Argentina and 37 per cent in Paraguay.

Soybean prices, which had pulled back from a high point in January 2021, have risen sharply again to a seven-year high since then, in response to the lack of moisture. With tighter supplies in South America, the higher global prices may stick around until the North American harvest.

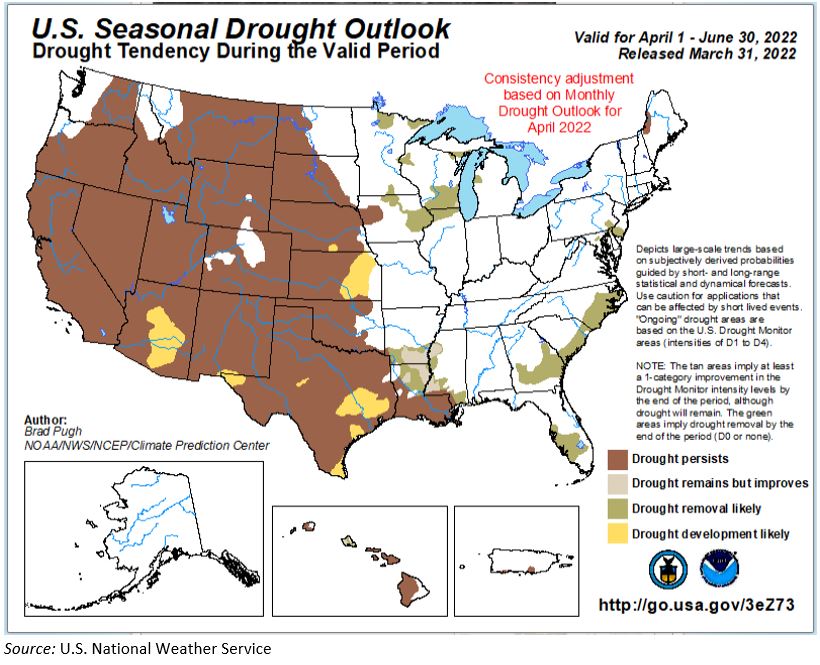

North America could be drier than usual this summer

In the U.S., growing conditions look less-than-favourable this year. The La Niña effect has caused a warmer- and drier-than-usual winter. According to the U.S. National Oceanic and Atmospheric Administration (NOAA), most of the country will be unseasonably warm between April and June, with some of the drier areas representing grain-producing regions. Drought conditions are expected to persist or develop for most of the western half of the U.S. over the next few months.

Production of hard red winter wheat this year, which makes up nearly 40 per cent of total U.S. wheat production, plunged 44 per cent because of drought in the northern plains. Areas in the Dakotas are still experiencing moderate drought conditions, and a repeat of last year could significantly disrupt U.S. spring wheat supplies.

Data out of Canada also points to some drier-than-normal precipitation levels over a significant portion of the arable prairies this spring. This is troubling, given that the region is coming off a year when feed grain supplies faced a 42 per cent shortfall in some areas and only a six per cent surplus in others. Another dry year could lead to significant feed disruptions.

Feed barley exports continue to grow

Coming off a drought-impacted 2021 harvest, feed grain exports from Canada continued a second year of decline. Crop year-to-date, 1.1 million tonnes of feed grains were exported as of early April. At this rate, Canada would be on target to export 1.7 million tonnes of feed grains by the end of July, down 9.3 per cent from last year.

Nevertheless, feed barley exports continue to increase. Last year, 1.5 million tonnes of barley were exported, and this year, Canada is on track to export 1.6 million tonnes, with almost all the crop pushed through the west coast terminals likely destined for Asia.

In a year when prices are supposed to be high because of feed shortages, the free market continues to dictate where grain is sold – to the highest-paying buyer. In this case, that means foreign markets. This has exacerbated shortages and pushed domestic feed grain prices higher, making hog production less profitable than it might be if the trend favoured selling into the domestic market.

Geopolitical strife always has a role in markets

Some countries have, in light of the global events earlier described, made efforts to ensure grain supplies. Egypt, Algeria and Serbia are a part of a list of countries that have banned the export of grain or food to combat their perceived food security problems.

China is the largest grain buyer in the international market. However, it would appear China is taking a protectionist stance by banning exports of its own fertilizer, in a bid to support its own domestic production. Observing this strategy, it calls into question whether the Canadian grain and livestock industries could work more closely together to benefit producers of all commodities.

The lack of fertilizer supply globally has driven up prices and increased the marginal cost of producing grain. This means that both food and feed grains will become more costly this crop season, even as Canada continues to ship feed grains out of the country, resulting in financial strain for domestic livestock producers.

While hog futures are looking favourable heading into summer, costs continue to push higher, offsetting much of the potential gains.

National Swine Congress of Mexico

Last week we attended the National Swine Congress of Mexico held at Barceló Maya Riviera a grand resort located south of Cancún in the Riviera Maya.

This coming week we will be at the British Pig and Poultry Fair in Stoneleigh Park, Warwickshire, UK. Visit us at the Genesus booth.(Stand #64A

Other Observations

OPOROMEX the Organisation of the Mexican Pork Producers in conjunction with the Hotel-Convention staff needs to be complimented for a well-planned and executed event. The facilities were first-rate.

Spain’s pork industry was invited to attend. Several people from Spain were part of the program augmenting Mexican speakers. There were several hundred thousand sows of Spain’s production represented by individuals and companies.

We have been doing business in Mexico for 30 years. Like most of the world, we have seen the industry consolidate. There are fewer producers but those who survived are larger. Major players include but are not limited to Kowi, Kiken, Norson, Smithfield-Carrols, and Okai. There are about 1 million sows in Mexico.

Feed prices have pushed higher like the rest of the world. Mexico’s current National Average Price is 36.51 pesos/kg (81.63¢ lb. U.S. liveweight). Many producers told us this is about breakeven.

Mexico usually has a hog price of about 10¢ lb. U.S. liveweight higher than the U.S. market. This is a reflection of the fact Mexico is a net importer of pork. The major source of imported pork is the United States. Mexico is #1 volume importer of U.S. pork. Year to date Mexico has imported 232,358 tonnes, same time a year ago 193,028 tonnes (+20%). Mexico has accounted for about 45%of all pork exports year to date. Huge important market.

PRRS and PED have been and continue to be a major issue cutting production. This has contributed to the increase of U.S. pork imports.

There are several large new sow unit projects being discussed in Mexico. In some areas, environmental issues will make expansion difficult. High feed prices and higher construction – equipment costs are pushing up break evens.

Usual suspects Global Swine Genetic Companies were present at the Congress. PIC, the different Danish companies, Dutch-Norway, Genesus. The consolidation of the Genetic business has also happened in Mexico. PIC is the leading sales company in Mexico and has been for a couple of decades.

In our opinion, Mexico’s industry will grow somewhat in the future. With 130 million people the main market is domestic consumption with some limited export opportunities due to higher cost of production. Mexico’s industry benefits from being a net importer. As we look at the world, the highest hog prices are in importing countries not in exporting countries.

Mexico has historically produced very lean hogs. The realization that better tasting pork could increase consumer demand has begun to be recognized. Good news for Genesus.

A week ago, we forwarded the article celebrating the 20 years of the Jim Long Pork Commentary on Porcicultura.com. At the Congress, it was great to visit with the Porcicultura team. They are a very professional group with a passion for the pork industry. We appreciate our past and future association.

China

Our premise has been and continues to be that the U.S, Europe, and China will have lower hog production in 2022. The first time in history that these three production centers will all be down at the same time.

How bad is China’s current market that tells us less hogs are coming? Below are the financial results of the 11 publicly traded companies in China for the first quarter of this year. Our Farmer Arithmetic, collectively they lost $2.5 billion U.S. (18 billion RMB). We estimate this group is about 1/5 to 1/6 of China’s total production. If we Farmer Arithmetic these losses to the whole industry we estimate $13 billion U.S. in the quarter. Or about $1 billion U.S. a week. One thing we believe is that when producers lose money, you get less pigs. When producers lose lots of money, you get a lot less hogs. We believe China started liquidating last July. Losses in the $70+ per head range for nine months. We expect China will see year-over-year decreases in hog numbers anytime now. Maybe the Covid lockdown could delay a hog price jump but it will delay not stop.

U.S. Dollars

U.S. Dollars