By Andrew Heck

Canadian consumers are demanding an explanation for the sticker shock they are experiencing at the grocery store.

In July 2022, general inflation in Canada was close to eight per cent – a four-decade high – cooling down to below five per cent in April 2023 and expected to move lower yet heading into 2024. Food price inflation, however, has continued to hover around 10 per cent for about a year. Even as general inflation eases, food price inflation does not appear to have followed suit.

Coincidentally, in the past year, profit margins for Canada’s major grocers were upwards of 10 per cent. Meanwhile, on the side of food production and processing, higher input costs, lower commodity prices and other factors have spelled negative margins for hog farmers and meatpackers.

When it comes to explaining why Canadians’ grocery bills are so steep, little of substance has been provided by those who know why or have the ability to do something about it. Grocery executives continue to pay themselves generously while shoppers watch their weekly bills get bigger. While it is impossible to offer a comprehensive explanation for all food categories, which stakeholders are making the most off struggling consumers?

Producers, processors and retailers are all within their rights to concern themselves with their bottom lines. Capitalism, at the end of the day, still reigns supreme in all parts of the value chain, just as in most sectors of our economy. While profit motive undoubtedly belongs in the equation, it would be inaccurate to suggest all stakeholders have been raking in the dough. The closer you look, the more obvious it becomes.

In the Canadian pork value chain, for years, producers and now processors have seemed to absorb a greater proportion of the mounting costs that retailers are able to recoup simply by charging more for their goods. As Canada’s grocery sector has steadily moved in the direction of oligopoly – with fewer and fewer legitimate choices – has big business finally reached a tipping point when it comes to providing essential food products and services, fairly, for Canadians?

As time goes on, consumers are rapidly losing faith in the belief that the cutthroat practices of large-scale supermarkets are leading to greater purchasing power for them. Certainly, the data – or lack of transparency around it – is making the disparity plain to see.

Grocers garner harsh criticism

Starting from the most visible part of the agri-food value chain, grocery stores were once trusted as ethical, people-minded enterprises that play a crucial role in any community. While at least part of that assumption remains true, skepticism has become a popular perspective.

When COVID-19 struck in early 2020, short-term losses for grocers quickly mounted, in response to gathering restrictions imposed by government and a need for physical distancing, masking and sanitation. As grocery employees were considered essential frontline works, several grocers began offering ‘hero pay’ to recognize and retain employees. At the time, it was surmised these necessary adaptations could account for immediate food price increases. While reasonable-sounding, pandemic living eventually became the norm. With restrictions already well-established, employee incentives were taken away, but prices kept climbing.

Executives from Canada’s three largest grocers – Loblaw Companies Ltd., Empire Company Ltd. and Metro Inc. – were summoned before the House of Commons Standing Committee on Agriculture and Agri-Food in early March to clarify the connection between food prices and corporate profits.

Those questioned included Galen Weston Jr., Chairman & President, Loblaw, with more than 2,400 stores in all provinces, including Real Canadian Superstore, No Frills, Zehrs and Provigo; Michael Medline, President & CEO, Empire, with more than 1,500 stores in all provinces, including Sobeys, Canada Safeway, Thrifty Foods and Longo’s; and Eric La Flèche, President & CEO, Metro, with nearly 1,000 namesake, Super-C, Food Basics and Marché Ami stores in Quebec and Ontario.

The committee wanted to find out whether current grocery prices equitably reflect the supply chain challenges that have cropped up since the start of COVID-19, when inflation and grocery revenue began to grow in step with each other.

When asked about his company, Weston used the example of a $25 grocery spend and suggested that $24 of that total amount represents accumulated supply costs, while only $1 represents profit for Loblaw.

“If we didn’t raise retail prices as costs went up, the companies that we operate would disappear almost instantly,” he said. “A hundred per cent of the profit in the food industry could go into lower food prices, and the price of the basket for that customer would still be 24 dollars.”

When pressed further to elaborate on his reasoning, Weston doubled down on his analogy, effectively silencing any meaningful inquiry.

“This one dollar of the 25 dollars is what we’re focused on, and all of this time, effort and exposition is focused on that amount,” he said. “No matter what is there – and there isn’t anything of significance there – that isn’t going to change the cost of food.”

When asked about Canada’s incoming grocery code of conduct – which is expected to be in place soon – Weston insisted Loblaw already negotiates with suppliers cooperatively, despite instances of “bad judgment on both sides,” referring to his company and manufacturers.

“We believe that we do business in a fair and transparent way 99 per cent of the time… It’s really important that any code or any set of practices that we engage in are properly balanced,” he said.

That one per cent discrepancy may have been a subtle reference to an earlier controversy that many Canadians will remember: in 2015, Loblaw sister company Weston Foods came under investigation by the Competition Bureau of Canada after being accused of colluding with Canada Bread as part of a price-fixing scheme that artificially inflated bread prices at retail for more than a decade. While the allegations were never proven in court, in 2018, Loblaw reacted by offering $25 gift cards for Canadians to use in its stores – a fitting and precedent-setting amount, foreshadowing the latest debacle.

In early April, just a month after the parliamentary hearing, Loblaw announced that Weston would receive a pay raise this year, based on last year’s stellar performance. Not long after, the company announced it would commit $2 billion to open 38 new stores and renovate 600 others. Certainly, expansion, not stability, remains the dominant mindset for Loblaw, as the company battles with only a handful of others like Empire and Metro – not to mention Costco Canada and Walmart – for highly coveted market share.

Suppliers squashed in several ways

While grocers continue to triumph, in meatpacking, the situation is far less encouraging for business.

When it comes to pork processing, profits for meatpackers were healthy and improving in the years immediately preceding COVID-19, but since 2021, that relationship has worsened from growth, to stagnation, to deficit.

Factors such as reduced access to high-volume pork markets like China, coupled with difficulties around finding workers, have hammered at the earnings of Canada’s largest pork processors, including Maple Leaf Foods, Olymel and HyLife.

Maple Leaf Foods reported its financials for the fourth quarter of 2022 in early March, including a loss of more than $40 million.

A cyber-attack led the list of problems, along with disruptions to the movement of pork and routinely poorly performing plant-based protein, from which the company has continued to lose money since it began investing in meat alternatives in 2017.

However, between 2021 and 2022, Maple Leaf’s sales increased from $4.5 billion to $4.7 billion total. Adjusted earnings for the company’s real meat category, while consistently positive, dipped from $527 million to $379 million, or by 28 per cent. Plant-based proteins managed to lose 17 per cent less, at only $105 million in the red, compared to $127 million the year prior.

Olymel, on the other hand, has faced a protracted series of disappointments in the past year. In November, the company announced the closure of its slaughter facility in St. Hyacinthe, Quebec. Then, in early February, the company closed two further processing plants in Blaineville and Laval, followed by an additional slaughter facility in Vallée-Jonction, in mid-April.

According to the company, “the decision was necessary to stop losses in the fresh pork sector, which have amounted to more than $400 million over the past two years and are jeopardizing the entire company’s profitability.”

In 2019, Olymel acquired rival brand F. Ménard for a handsome, undisclosed amount, consolidating a good chunk of the province’s hog production, integrated with the company’s existing pork processing capacities and related functions, like feed milling and trucking. It was expected that this decision would eventually pay off, but the unfortunate timing, occurring just prior to COVID-19, has proven daunting.

For HyLife, cracks have begun to show more recently, in early April, as the company has struggled to sell off its slaughter facility in Windom, Minnesota, originally purchased in 2020, right as COVID-19 had taken hold. The plant was acquired to increase overall capacity, in addition to HyLife’s main plant in Neepawa, Manitoba.

A common domestic theme for all meatpackers has been a lengthy list of labour concerns. While HyLife never experienced any plant closures due to workers being infected with COVID-19, Maple Leaf’s plant in Brandon, Manitoba; Olymel’s plant in Red Deer, Alberta; and Conestoga Meats’ producer-owned plant in Breslau, Ontario were all shuttered for several weeks due to outbreaks in 2020 and 2021, resulting in disruptions to the supply of pigs and pork.

During the plant outbreaks, at least one worker died as a direct result of contracting COVID-19, causing a news media stir and adding fuel to the fire for critics of the meat industry. On top of that, as temporary and permanent plant closures across the country have resulted in the laying-off of workers, labour rights advocates and unions have pressured governments to adopt stricter measures to protect workers. While the desire to support workers is entirely justified, there is no question the circumstances surrounding those outcries have had the effect of gradually chipping away at processor margins.

Given the examples of Maple Leaf, Olymel and HyLife, it is clear food suppliers have been under the gun more intensely in recent years. In some cases, companies’ misfortunes have resulted from untimely or misguided business decisions, but in other cases, uncontrollable pandemic-related factors have taken a toll that has been felt at both ends of the value chain.

Pig and pork production absorb heavy blows

Hogs raised by Canadian producers – processed at facilities like those owned by Maple Leaf Foods, Olymel, HyLife and a few others – are regulated by the Canadian Food Inspection Agency (CFIA), representing upwards of 99 per cent of total production across the country, though this does not translate to the volume that is sold in Canadian grocery stores, which can include cheaper pork of foreign origin.

Hogs procured by CFIA-inspected processors are priced according to market formulas derived from mandatory, daily reports compiled by the U.S. Department of Agriculture (USDA), which reflects aggregated prices paid by processors to producers in the U.S. In Canada, no such reporting mechanism exists, which has been an ongoing problem that provincial pork producer organizations and the Canadian Pork Council (CPC) have been trying to address for years. Political buy-in has been lukewarm, at best.

Between 2000 and 2020, it is estimated that Canada lost more than three-quarters of all independent hog producers, while consistently growing the size of the country’s total pig herd. This phenomenon is not due to a declining interest in raising pigs or selling pork, but profitability barriers that have made modern agriculture inaccessible without sufficient capital. Partly because of this, one approach by processors has been to vertically integrate their hog supplies by either owning barns outright or independently contracting producers as finishers for more of the hogs that end up at their plants.

This suggests that, while we have fewer farmers making a living off commercial hog production, those few have expanded their operations to make up the difference, as global demand for protein continues its bullish trajectory. As the number of hogs produced has levelled off in recent years, and the number of producers continues to drop, it is easy to speculate as to why, given the situation at-hand.

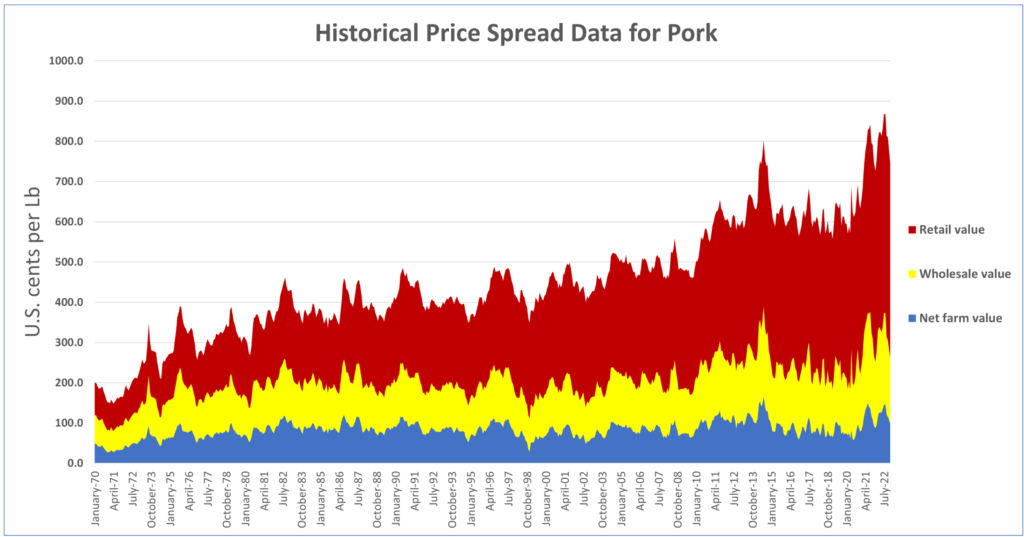

Since the 1970s, data gathered from the USDA suggests the share of value between producers, processors and retailers has not stayed proportional. Extrapolating this data for a Canadian context is not a perfect comparison, but given the inter-connection between our national industries, the relationship is about as close as we can get without better, currently non-existent data.

Canadian market hogs are priced using processor-specific formulas that reference the USDA’s information, as a starting point. From there, hogs are measured against a ‘grid’ that includes a range of weights falling below or above an ideal target, which sets the starting price. Then, carcasses are assessed for indicators of quality – like fat marbling, loin depth and colour – which may be paid out in the form of premiums and bonuses defined by a producer’s contract.

To evaluate hog prices in a general sense, market analysts use a standardized 100-kilogram ‘dressed’ carcass, referring to one that has been slaughtered and has had most of its non-meat features removed. Considering the financial share of that carcass, one that fetches a producer $200 can be sold by a processor for roughly $300 in profit once broken down into ‘primals,’ or large, basic cuts. Most primals are sold to wholesalers internationally or domestically, to perform further processing in any number of ways.

Fresh or frozen cuts like loin chops, racks of ribs, belly portions and shoulder roasts – along with cured products like bacon, deli meats and sausages – are among some of the many options Canadian consumers have when it comes to purchasing pork in-store. While detailed sales data for these items is not publicly known, even taking a low-end estimate of $8 per kilogram – the price of ground pork at Real Canadian Superstore, as of early 2023 – that would mean the full value of the meat from a hog carcass approaches $800 at retail, which is, conservatively, about four times what a producer earns and at least twice what a processor earns.

While the numbers cited here cannot be exact and are highly variable, a picture of proportionality begins to emerge: producers and processors, together, take home only a meagre slice of the total value of the pig, most of which belongs to the retailer and its middlemen. Granted, these middlemen represent additional input costs for retailers, on top of losses attributed to meat that goes unpurchased and is wasted. However, until retailers choose to shed a brighter light on the breakdown of their costs, as a way to rationalize what they charge and justify their margins, consumers and the rest of the pork value chain are left guessing.

Farmers bear the brunt of the burden

Consider what it takes to get the pig from farm to fork: from ‘farrowing,’ or birth, the pig is raised to market weight at six-months-old, then hauled to the processing plant, where the next steps take a mere matter of days. From there, its outputs are sold and shipped all around the world to end users who may get weeks or months of shelf life out of the product, depending on how it is prepared or stored.

All in all, while processing and retail are indispensable parts of adding value to the hog carcass, most of the time commitment – and much of the up-front risk – lies with the producer. Producers, being at the beginning of the value chain, have little to no recourse when it comes to affecting the prices paid for their pigs, while facing the same unstable market conditions as processors, with none of the mark-up ability of retailers.

While input costs have increased across the board throughout agri-food, livestock feed, energy costs and insurance rates have gone up faster than hog prices. When looking to re-invest into a hog operation, including modernizing barns for eco-efficiency and animal welfare standards, producers have suffered, as the confidence of lenders has eroded. On top of that, if a producer underperforms in another area of his total farm operation, such as reduced crop yields during an off-year, government-funded business risk management (BRM) programs are often insufficient to balance out total losses.

With everything considered, it is hardly short of miraculous that many of Canada’s food producers are able to stay afloat at all.

Market downturns make it tougher

Market conditions for pigs and pork took a sharp turn, starting in late 2018, with the outbreak of African Swine Fever (ASF) in China. Almost overnight, pork values for processors jumped dramatically as China looked to fill the void left by widespread culling of animals on its farms, which led to a situation of unexpected low supply but predictable high demand for protein, with pork being the cultural preference even among other options like beef, chicken and seafood.

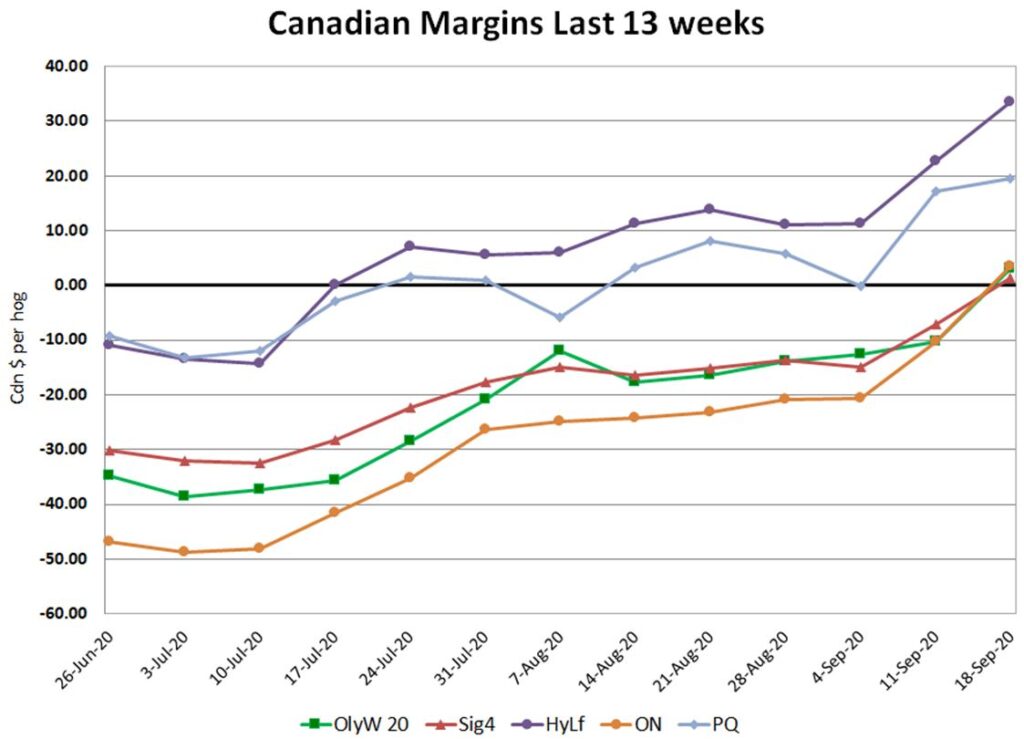

Shortly after ASF hit China, hog prices in western Canada were around $150 per hog, with cost of production estimated at around $180, signifying a $30 loss. This period continued until 2020, when COVID-19 struck. While summertime usually spells the highest hog prices, they sunk to around $140 per hog, as costs approached $200. Producers were then losing more than $50 per hog, on shipments of about 200 hogs per week, for many weeks of that year.

Recognizing the severity of what was happening, western Canadian producer organizations – B.C. Pork, Alberta Pork, Sask Pork and Manitoba Pork – approached processors with a humble request to work toward bringing about some relief in their pricing structures. Olymel made favourable adjustments to its base pricing and bonuses, while Maple Leaf introduced a pricing floor, which temporarily kept base prices from falling too far, too fast. Separate from the producer organizations’ request, HyLife had recently introduced base pricing using cut-out (primal) values, rather than whole carcass values, which were lower. The net effect of all these changes was a small boost for producers. But, despite the efforts, which were appreciated, little could have prevented the damage that had already been done.

This situation ended up financially crippling many, as a result of that comparatively short period of market volatility alone. Some producers managed to limp through the most difficult parts, while others did what they could to escape the industry with as little collateral damage as possible.

While hog prices stabilized and became favourable through much of 2021 and 2022, costs kept climbing to historical highs. In good times, producers may have profited between $60 and $100 per hog for several weeks in the summer months of 2022, descending to break-even, at a low point, during this past winter. As of the first part of 2023, hog prices were sitting at $230 per hog, though future pricing estimates suggest this summer will be mediocre, if not outright negative. Compounding the problem, costs have yet to cool down, now upwards of $240 per hog.

It would seem that the roller coaster ride is set to continue, and for those who are unable to stomach the inevitable ups and downs, they may be looking to bow out. Should the number of active producers, once again, shrink faster than the reduced hog supply can be displaced, it will have a ripple effect on everyone, from processors and retailers, to consumers.

Producers and consumers deserve better

Despite the pork value chain’s internal struggles, for consumers, pork stands out as a candidate for being incredibly nutrient-dense and easy-to-prepare, along with being unusually affordable in the current high-price environment.

Retail pork prices by weight have actually declined year-over-year, making pork attractive relative to its red meat cousins, poultry and heavily promoted fake meat substitutes. Other categories of food – like produce, bakery and dairy goods – have increased.

And while the Canadian public should be encouraged to keep purchasing pork – undoubtedly, a mutual benefit for the consumer and industry alike – it may enhance their understanding if they took a deeper dive into the parts of the value chain that are less observable to the average person.

In the absence of clear answers to questions around food prices, and solutions to bring them closer to what is considered ‘fair,’ consumers will continue to eat. For the vast majority, that means frequenting grocery stores, often with few true options or cost savings to be had. Unfortunately for consumers, just like producers, most of the bargaining power does not belong to them.

At the same time, as pig prices fail to represent an equitable share of producers’ efforts, and as processors grapple with treacherous territory in the global pork marketplace, farmers and meatpackers will continue to deliver their products – feeding Canadians and the world. But for how long can it last in an economically sustainable fashion, under current constraints?

Consumers should not feel guilty about buying pork at discounted prices – hypothetically and unintentionally on the backs of producers – but they should keep searching for the reasons why grocery prices are the way they are, no matter the food item. Producers, too, will keep pressing.